Best Stocks By Dividend Yield

Screen over 46,000 companies to find the best stocks by dividend yield meeting your criteria, see Morningstar analysts' best dividend stock picks, stock research reports & 2-year dividend forecasts for ASX200 stocks, inside Morningstar Investor. Sign up for a FREE 4-week trial^ now to get access. No credit card needed.

No credit card required.

Dividend Stocks

|

Stock Name

|

Market Cap (mil)

|

Latest price

|

Dividend Yield

|

Price/Earnings

|

Morningstar Rating

|

|---|---|---|---|---|---|

| 1. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 2. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 3. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 4. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 5. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 6. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 7. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 8. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 9. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 10. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

*Sign up for a FREE 4-week trial^ of Morningstar Investor to unlock access to our dividend stock research & data. No credit card required.

About Us

We’re all in for investors.

Morningstar is a leading source of independent investment research for stocks, funds, ETF's, credit, and LIC's as well as financial data, news, investing tools.

It started with an idea—one great idea from a 27-year-old stock analyst. Joe Mansueto thought it was unfair that people didn’t have access to the same information as financial professionals. So he hired a few people and set up shop in his apartment—to deliver investment research to everyone. We didn’t know then what the company would look like today, but we knew the commitment to our mission—to empower investor success—wouldn’t change. Now, we operate through wholly- or majority-owned subsidiaries in 32 countries. We’ve empowered investors all over the world, and we’re continuing to look for new ways to help people achieve financial security.

Our research is independent, which means we do not charge or accept payment or commissions from fund managers, listed companies or other product issuers to produce research on their products. Our mission remains true today, 39 years after that one great idea – we believe in the democratization of investment information, research and data. Our mission is at the core of everything we do – to empower investor success.

Your FREE 4-week trial^ of Morningstar Investor Gives You Access To More Than Just Our Best Dividend Stock Picks

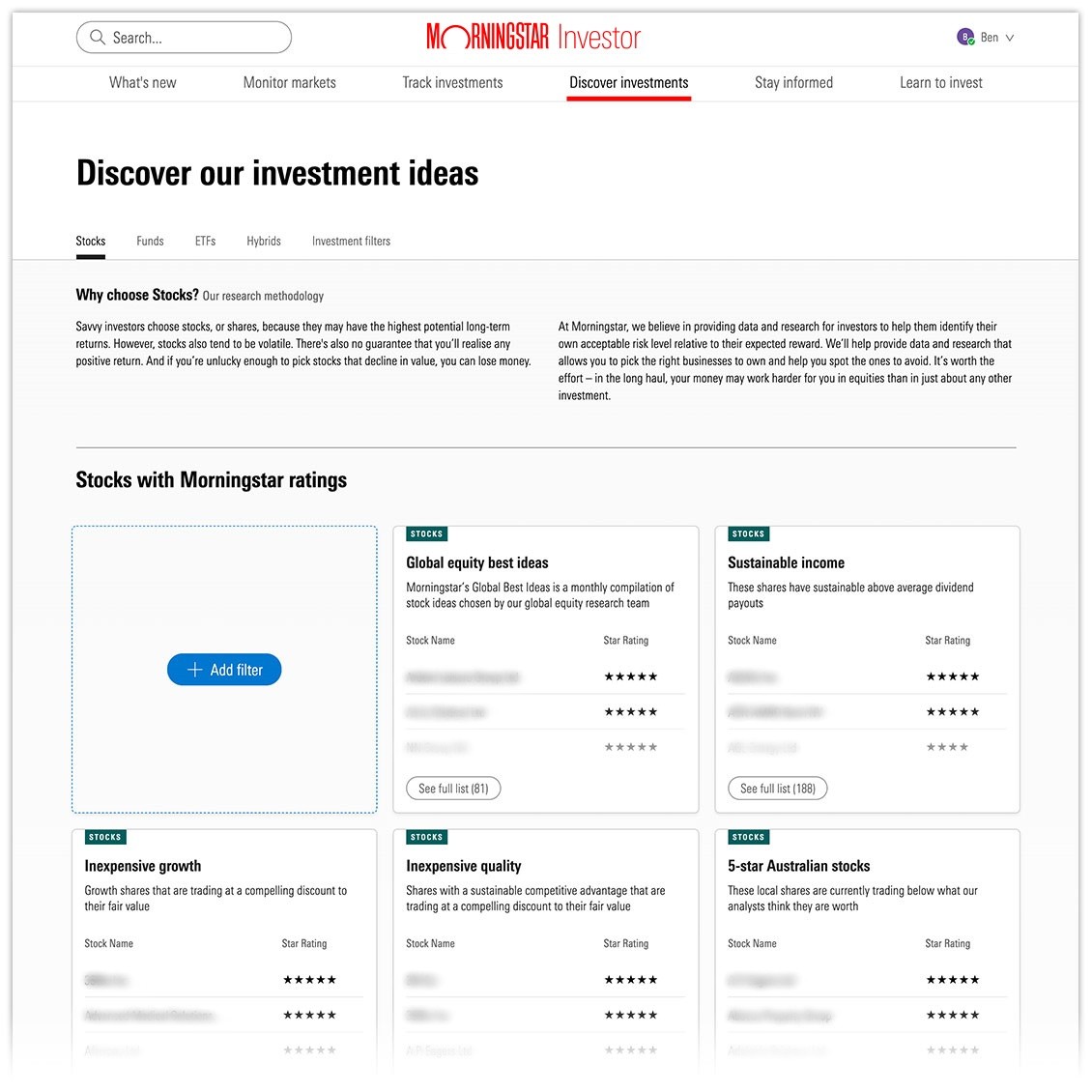

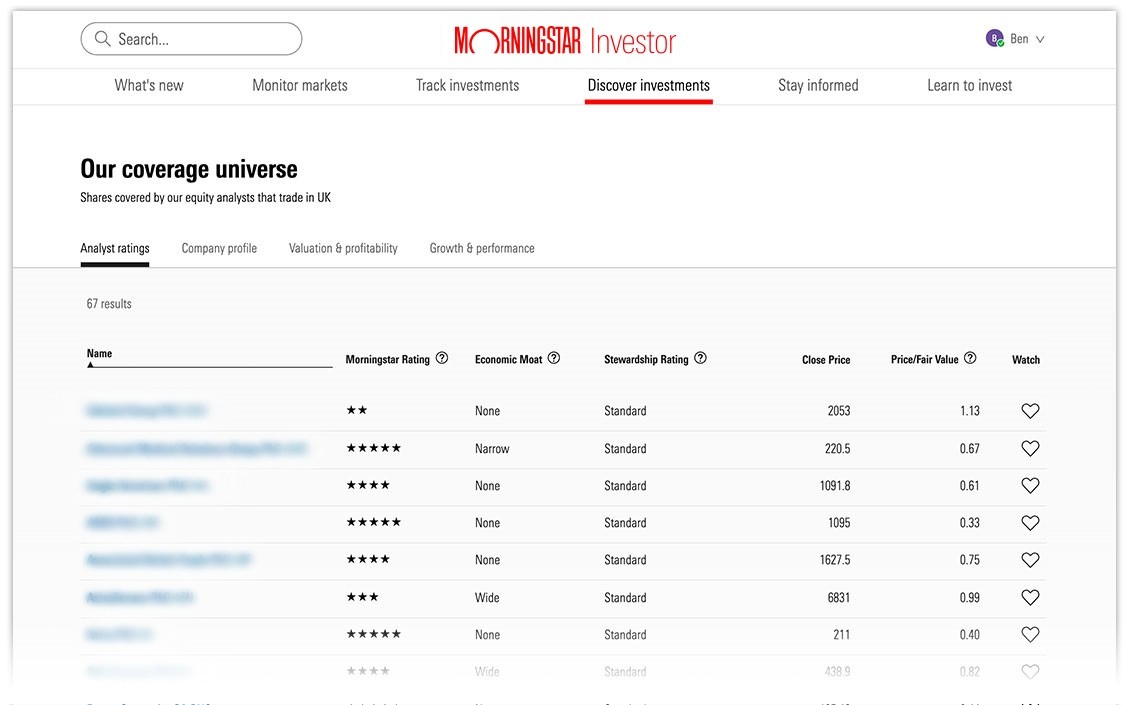

Discover investments

Find investment opportunities which fit your needs with our equities, ETFs, Funds and Hybrids coverage.

- Access qualitative analyst research on more than 1,600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds, plus data on over 48,000 global securities

- Access our top equity picks, including sustainable dividend generating stocks, 5-star Australian and global stocks, 5-star Australian and global listed property stocks, sustainable investing stocks and more

- Easy-to-use, customisable filters to quickly identify investments which suit your goals

- Stock filter options include sector, market cap, dividend yield, franking percentage, payout ratio, Morningstar rating, economic moat, price/earnings ratio, return on equity, annualised return and more

- ETF and Fund filter options include yield, total cost ratio, annualised return, category, management style, Morningstar analyst rating, sustainability rating and more

- Keep an eye on price movements and Morningstar ratings as you wait for a more compelling opportunity with a customisable watchlist

No credit card needed.

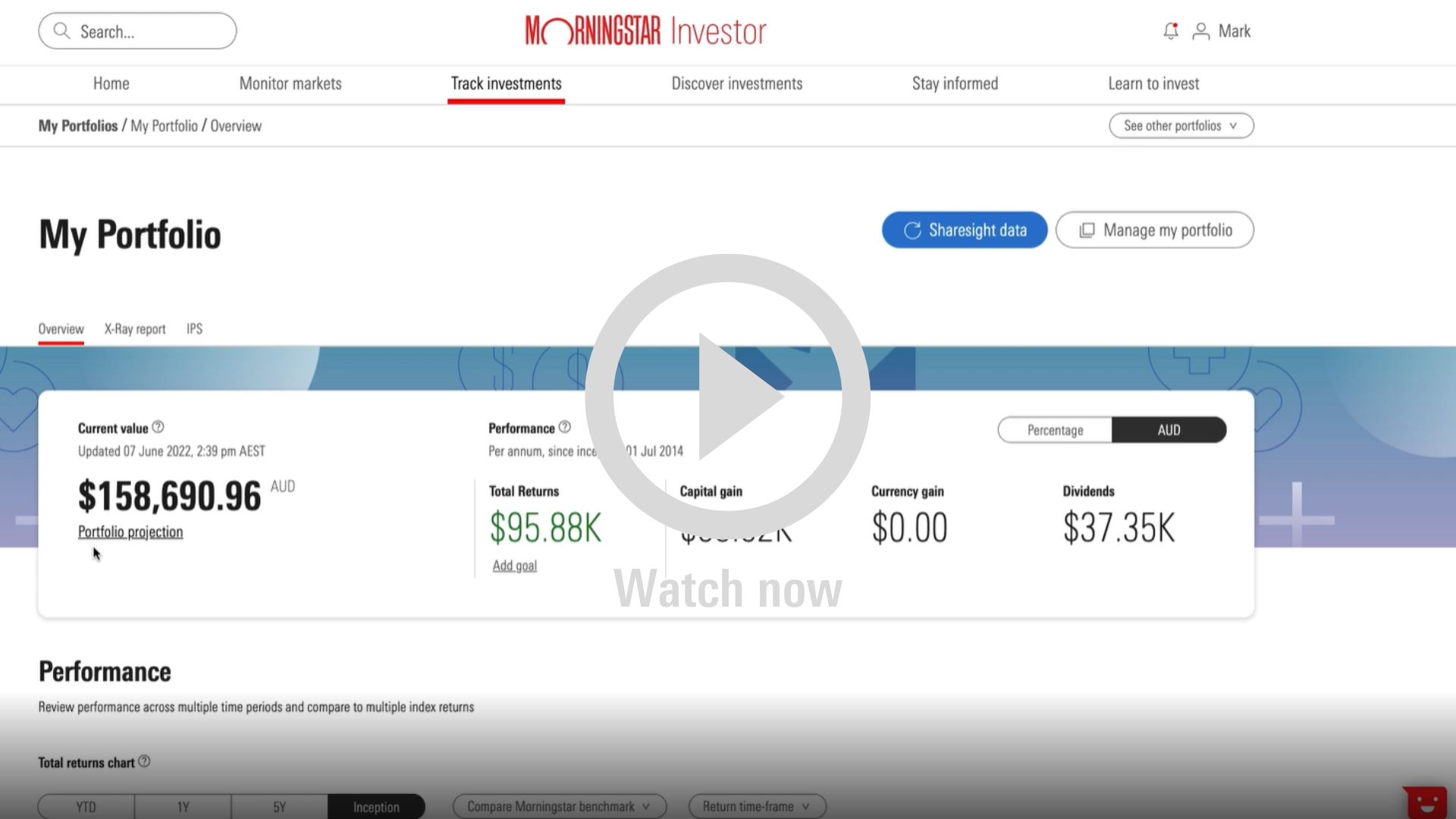

Track & analyse investments

Morningstar Investor includes complimentary access to Sharesight’s Standard Plan, one of Australia’s leading portfolio trackers (valued up to $372 p.a.) Sharesight’s integration into Morningstar Investor’s portfolio manager allows you to:

- Track all of your investments in a single location

- Easy dividend tracking with corporate actions automatically incorporated in portfolio reports

- An integration with Morningstar’s data and research: garner insights on your holdings from our team of equity and fund analysts

- Know your portfolio's true performance with daily price & currency updates

- Save time during tax time with streamline portfolio and tax reporting

- Know your exposure: Take a deep dive into your portfolio with Morningstar’s Portfolio X-Ray – get region, sector and style breakdowns

- Stay on top of your investments with email alerts for new corporate events, sudden movements in price, plus a weekly portfolio performance summary

No credit card needed.

Already a Sharesight user? We’ll pick up your bill (up to the value of the Standard Plan)

Monitor markets

We contextualise day to day market movements with our view of the overall market valuation so you can focus on the long-term investment opportunity.

- Explore index, commodity and currency changes

- See the current price to fair value of each market we cover along with the valuation from a year ago

Stay informed

Our journalists in Australia, North America and Europe deliver insights from our wide breadth of equity, fund and ETF research, our in-house behavioural science researchers and our investment management team.

- A view on markets and investing focused on sound analysis rather than snap reactions to market events

- Access to our latest equity, fund and ETF research

- Commentary and insights on latest economic, political and business news

Learn to invest

Knowledge is the foundation of independence. As a Morningstar Investor member, you'll receive access to investing guides covering a wide range of topics. These are designed for both novice investors and experienced investors looking to review key foundational topics.

- Discover strategies to build wealth via stock, fund and ETF investing

- Learn fundamental frameworks for successful long-term investing

- How to build a portfolio aligned to your goals

No credit card required.

Frequently Asked Questions

➣ Why does Morningstar’s ratings on my broker platform differ from the ones in Morningstar Investor

The research that you receive through your Morningstar Investor Membership is qualitative—our analysts have rated the stock and provided input and opinion to the final fair value. The research that you access through your broker is quantitative in nature – what this means is that the fair value is decided based on data inputs and algorithms, without weigh in from our analysts.

This is why the research and ratings may differ between your membership and your broker.

Morningstar Investor is not a broker service – it offers a different service to your broker – focusing on providing investors a holistic portfolio management tool that helps you track, monitor and maintain your investments.

➣ I receive Morningstar ratings for free from my broker. How is this product different? What is the difference if I access it directly?

The level of access to Morningstar ratings and data differs broker to broker, but in most instances, the ratings that you receive free from your broker are quantitative in nature. This means that fair value (the long-term intrinsic value of a share) that is assigned to a share is calculated based on an algorithm. As part of Morningstar Investor, you receive access to qualitative analyst research on more than 1600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds.

Morningstar Investor is a holistic solution that is focused on the investor, and not the investment. It offers access to ratings, as mentioned, and data on over 48,000 securities. It also includes analyst insights and editorial thought leadership, including forecasts for ASX/200 stocks.

As part of your subscription, you also receive access to a Portfolio Manager that is powered by award winning Portfolio Tracker, Sharesight and integrated with Morningstar research and data. This is accompanied by a suite of tools and calculators to help investors reach their investing goals, including goal calculators, asset allocation models, ETF model portfolios and more.

➣ Is Morningstar Investor a broker service?

Morningstar Investor does not offer investors the ability to trade securities.

➣ What if I already have Sharesight subscription?

If you already have a Sharesight subscription, we will pick up your bill (up to the value of the Standard Plan). For existing Sharesight subscribers, you are able to link your existing account to your Investor subscription. If you are on the monthly Standard Plan, the billing will be directed to Morningstar from the following month. If you are on an annual plan, the next annual payment will be paid directly by Morningstar. If you are on a higher priced plan you will be charged the difference between the Standard Plan cost and your plan.

No credit card required.

How to choose dividend stocks

Dividend payers such as the big four banks, BHP Group, and tollroad operator Transurban are prized by Australian investors searching for income in retirement. The taxation system also richly rewards shareholders who can take advantage of franking credits.

Dividends are an indication that a business is established and financially healthy enough to return cash to shareholders. They also force management to focus on the long term and their capital-allocation decisions.

Sadly, however, so-called high yield stocks are not necessarily the best buys. Choosing stocks with the highest dividend yield can lure investors into risky corners of the market, exposing them to financial distress, dividend cuts, and share price declines.

We'll look at six factors that can contribute to a sustainable dividend.

1. Seek 'healthy' payout ratios

One of the most important statistics for dividends is a company's payout ratio.

As the name suggests, the payout ratio is the proportion of a company's earnings paid out as dividends. For example, if a company pays out $2 a share and has $5 of earnings, 2 divided by 5 is 0.4 – or 40 per cent. The payout ratio is 40 per cent.

A lower payout ratio can indicate that the dividend is "healthy".

There is a margin of safety that allows a company to miss its earnings target and still be able to pay out its dividend, and there may also be room for management to increase the dividend over time.

A payout ratio over 100 may indicate that the dividend is in jeopardy because no company can continue to pay out more than it earns indefinitely.

The payout ratio is a key number in evaluating dividend safety. But it's not the only statistics to consider.

For example, what's a good payout ratio for a utility – say 70 per cent – might be much too high for a steel mill or an oil refiner, which are much more volatile businesses where earnings could be wiped out at the bottom of a cycle and the dividends get cut.

Investors should think about how a payout ratio balances against the company's need to invest for internal growth, as well as providing that cyclical safety margin for future downturns.

2. Make sure your dividends grow

Ultra-high dividend yields can be particularly attractive in the current low-return environment, but it’s important to resist the temptation to load up on these shares. Investors may be better placed seeking companies who not only pay out dividends but also have a track record of continued dividend growth.

If a company just raised its dividend, it's quite unlikely – unless it has a deliberately and obviously variable policy for paying dividends on a quarterly basis –it's going to turn around and cut it immediately.

Companies that are focused on growing dividends tend to be higher-quality, cash-rich businesses that hold up well in down markets, participate in up markets, and are capable of excess returns over a full market cycle.

But like the payout ratio, growing dividends is not a perfect indicator.

Dividend cuts in the past don't mean that dividend cuts are going to be there in the future, and the absence of a cut doesn't guarantee that the dividend won't be cut in the future.

But if there is a pattern of dividend cuts, it can raise important questions about the business. It may be too volatile to sustain what you expect.

3. Does it have a moat?

Why do moats matter when it comes to dividend stocks? Companies which have a sustainable competitive advantage tend to be better able to generate free cash flow and raise their dividend payouts over time and through periods of volatility.

Coca-Cola is an example of a wide-moat company. It has good profit margins, the opportunity to expand them further and generates significant amounts of free cash flow.

4. Don't ignore the balance sheet

Investors should consider both equity metrics - such as price-to-earnings and earnings-per-share – and balance sheet metrics such as gearing (or borrowed money), interest coverage and net debt / EBITDA.

As creditors stand ahead of investors in line for company cashflows, a healthy balance sheet – or a balance sheet with more total assets than liabilities – is a positive when it comes to selecting a dividend stock.

A company with a strong balance sheet can also go to the market and borrow cheap debt to pay for acquisitions, projects that they're doing internally, instead of issuing new equity or reducing dividends.

A good rule of thumb is to be extra sceptical of companies with interest coverage ratios (EBIT/interest expense) below three times or net debt/EBITDA ratios above two times.

5. Pay attention to valuation

Buying a share for their dividends and yield alone may save you from making emotional trading decisions based on share price volatility, but constantly overpaying for shares is no formula for success. A company with a fat dividend yield is only attractive at the right price.

A good way to get a sense of a stock’s valuation and whether or not it can sustain it is to look for stocks that are trading at or below Morningstar’s fair value estimates, which considers all of our research and forecasting of a company's future financial performance.

Investors may also like to buy stocks with a "margin of safety”—that is, companies trading at a meaningful discount (at least 10-15 per cent) to their fair value estimate.

6. Look at free cash flow and beware of ‘pseudo dividends’

Excess free cash flow is a crucial sign of a company’s ability to maintain sustainable dividends. That way, if a company goes through a tough year, they may still have enough of a buffer to maintain their payout.

But don’t forget to consider how that free cash flow is generated. Is it relying on debt to pay unsustainable, ‘pseudo’ dividends?

If you look for companies with at least 1.5 times free cash flow cover, about two thirds of earnings and free cash flow will be used to pay the dividend – leaving you with a margin of safety for a potential short-term drop in cash flow.

^This offer is limited to new clients and cannot be used in combination with any other promotional offers and cannot be used to extend an existing Investor Membership. One free trial per household. Morningstar is licensed to provide our subscription service to Australian residents only.

© 2025 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This report has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or New Zealand wholesale clients of Morningstar Research Ltd, subsidiaries of Morningstar, Inc. Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

Legal Notices Privacy Policy Regulatory Disclosures Global Contacts