Franked Dividend Shares

Screen our database of 46,000 Australian and global companies and generate a list of dividend shares meeting your criteria which offer franking credits. See our detailed share research reports, 2-year dividend forecasts on ASX200 shares, fair value ratings and more, inside Morningstar Investor.

No credit card required.

Dividend shares

|

Share Name

|

Market Cap (mil)

|

Latest price

|

Franking %

|

Dividend Yield

|

Morningstar Rating

|

|---|---|---|---|---|---|

| 1. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 2. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 3. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 4. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 5. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 6. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 7. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 8. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 9. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

| 10. XXXXXXXXXX | XXX.XX | XXX.XX | XX.XX | XX.XX | XXXX |

*Sign up for a FREE 4-week trial^ of Morningstar Investor to unlock access to our dividend share research & data. No credit card required.

What is a franked dividend?

An imputation or franking credit is a note that comes with share dividends that says company tax has already been paid on the dividend. This gives the shareholder a discount on their tax at tax time and thus avoiding double taxation.

How do franked dividends work in Australia?

Dividend imputation was implemented in 1987 by the Hawke-Keating Labor government, to prevent double taxation. Under this system, Australian companies would still pay company tax and post-tax dividends to shareholders, but they could declare how much tax it pays to be "imputed" with the dividend it paid.

Before dividend imputation was introduced, Australian companies would pay company tax on profits, and then if it paid a dividend to shareholders, this was taxed as part of the individual's income.

The payment of franking credits with dividends enables Australian resident taxpayers to reduce their personal tax liability but, since 2002, franking credits are also refundable, meaning taxpayers with a low or zero marginal tax rate can generate additional gross income from franking credits.

Contrary to a common misconception, the gross value of franking credits does not vary with a shareholder’s marginal rate of tax, and is equivalent to other sources of gross income, such as bank interest and dividends on shares.

The dividend imputation system encourages Australian companies to return capital to shareholders via dividends and leads to relatively high payout ratios. This happens despite the existence of the capital gains tax discount, or CGT. It also reduces the appeal of directing capital to other potential uses, such as reinvestments in the business, growth by acquisitions, or on-market share buybacks.

Franked vs Unfranked dividends

Franking credits can materially increase the income earned from Australian equities by Australian resident taxpayers. This effectively boosts the cash flows from dividends to those shareholders, and in turn the intrinsic value of those shares to those investors.

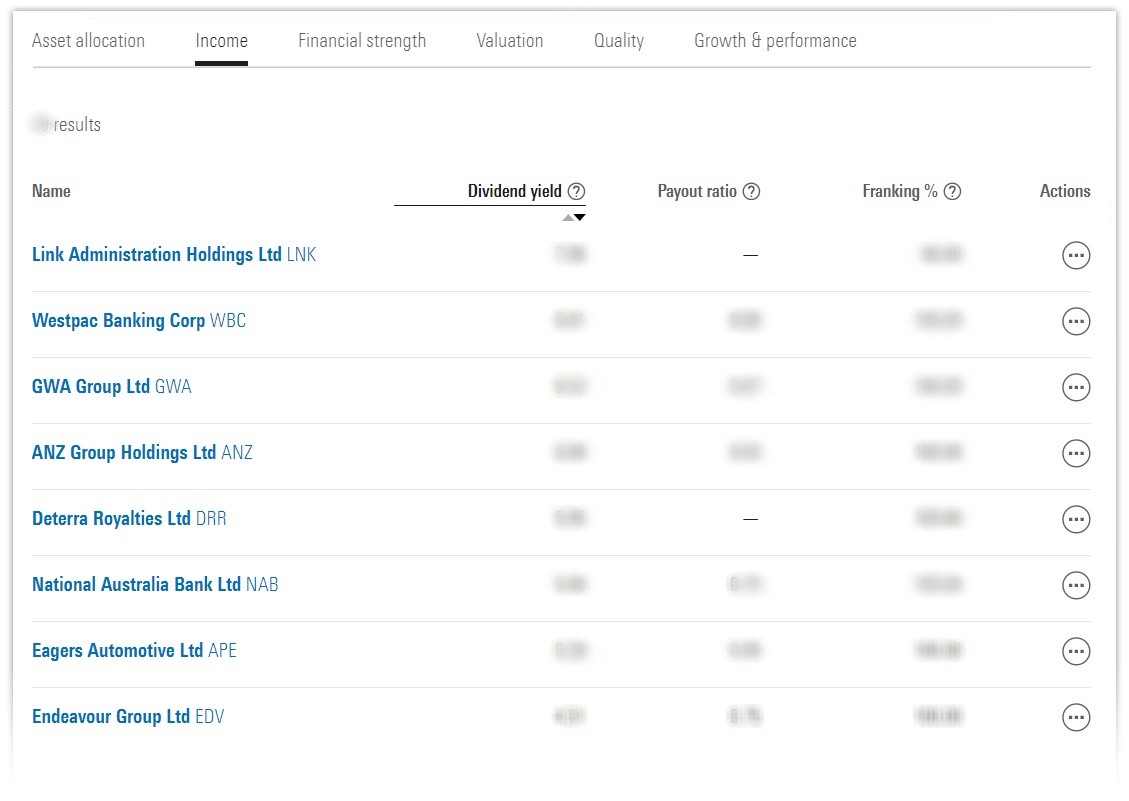

Which shares pay franked dividends?

Morningstar Investor’s premium share screener can help you find franked dividend shares that meet your criteria.

Filter over 46,000 ASX and global shares to find companies meeting your criteria, including franking percentage, dividend yield, payout ratio and more:

How to select shares with sustainable franked dividends

Income investing is about more than simply buying companies with high short-term dividend yields, which could signal future earnings and dividend weakness rather than relatively high returns, a situation known as a yield trap. In addition to Morningstar's star ratings and price/fair value estimates, we recommend investors consider Morningstar's proprietary ratings when evaluating income shares. Income investors can also assess dividend sustainability via financial statement and earnings forecasts analysis, such as the following metrics:

Morningstar Economic Moat Rating: The Morningstar economic moat rating measures a company's ability to protect its profits from competition. Narrow- and wide-moat-rated companies are more likely to sustain profits and therefore dividends than companies with no economic moat. Organic revenue growth: Organic revenue growth is arguably a more sustainable source of revenue growth than acquisitions or cost cutting. Income investors should therefore assess the extent to which revenue growth is organic and sustainable and if acquisitions are masking a weak core business which could threaten dividend sustainability.

Customer concentration: High customer concentration can pose a significant threat to revenue, earnings, and dividends. The loss of a large client or contract could significantly impact revenue and be exacerbated by operating leverage, causing profits and dividends to fall. Income investors should therefore assess the degree of customer concentration in addition to key contract terms and expiry dates.

Recurring revenue: Companies with a high proportion of recurring revenue should experience more sustainable dividends and resilience to economic downturns.

Margin compression: Strong businesses with economic moats should demonstrate resilient profit margins. Falling profit margins imply competition is eroding profits and may lead to future dividend cuts.

Dividend payout ratio: Dividend payout ratios should be sustainable. Morningstar analysts assess the suitability of dividends within their Capital Allocation analysis. However, paying dividends while increasing debt or raising equity, or a dividend payout ratio of over 90% may indicate unsustainable dividends.

About Us

We’re all in for investors.

Morningstar is a leading source of independent investment research for stocks, funds, ETF's, credit, and LIC's as well as financial data, news, investing tools.

It started with an idea—one great idea from a 27-year-old stock analyst. Joe Mansueto thought it was unfair that people didn’t have access to the same information as financial professionals. So he hired a few people and set up shop in his apartment—to deliver investment research to everyone. We didn’t know then what the company would look like today, but we knew the commitment to our mission—to empower investor success—wouldn’t change. Now, we operate through wholly- or majority-owned subsidiaries in 32 countries. We’ve empowered investors all over the world, and we’re continuing to look for new ways to help people achieve financial security.

Our research is independent, which means we do not charge or accept payment or commissions from fund managers, listed companies or other product issuers to produce research on their products. Our mission remains true today, 39 years after that one great idea – we believe in the democratization of investment information, research and data. Our mission is at the core of everything we do – to empower investor success.

Your FREE 4-week trial^ of Morningstar Investor Gives You Access To More Than Just Our Top Dividend Share Picks

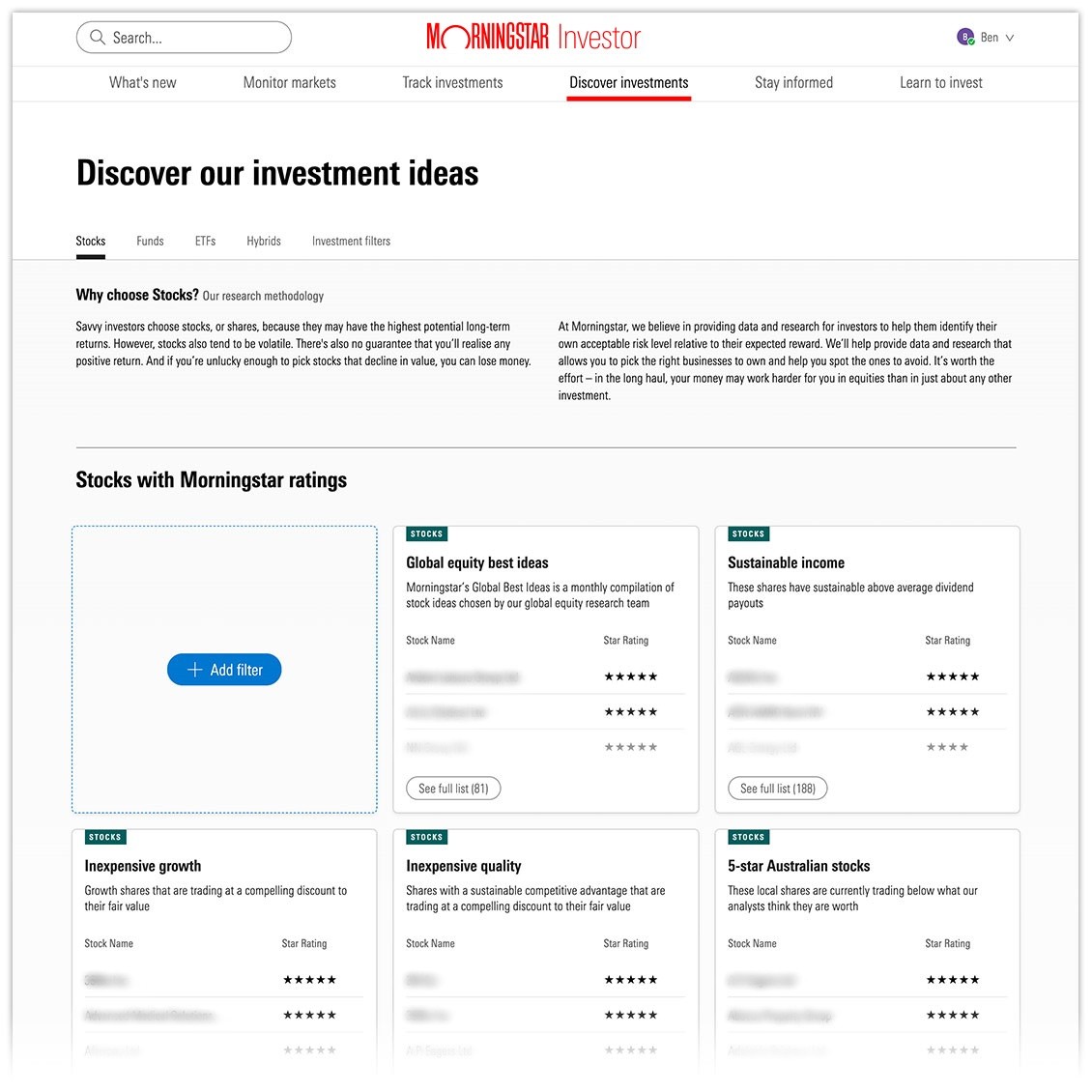

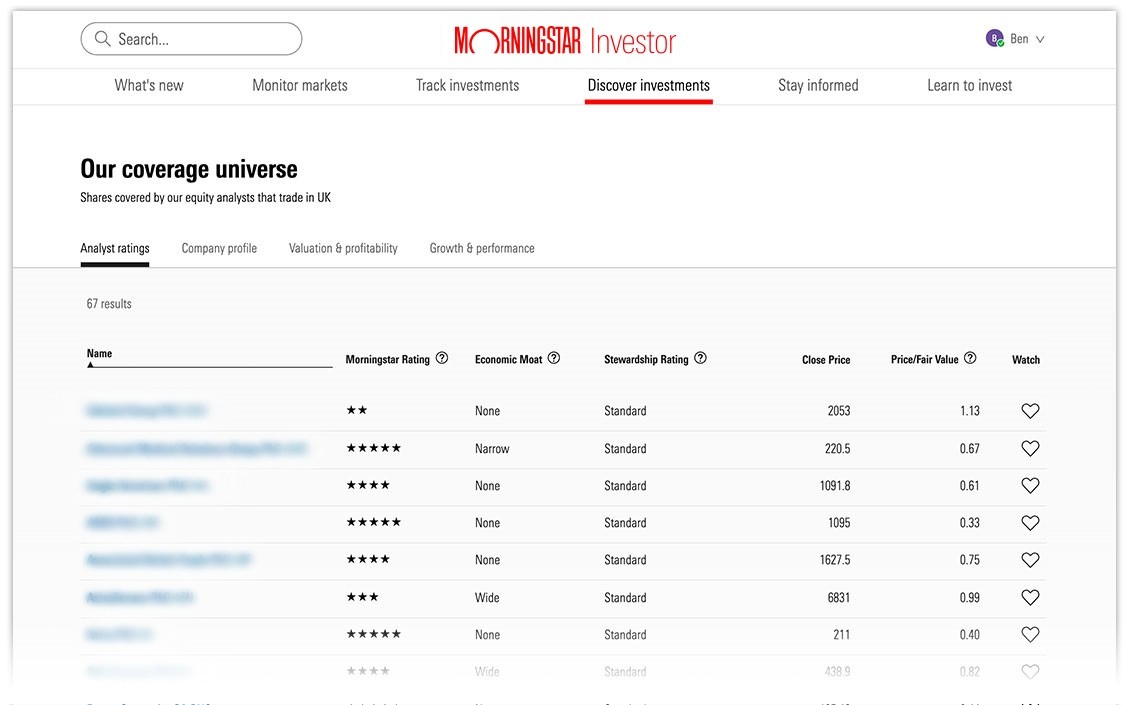

Discover investments

Find investment opportunities which fit your needs with our equities, ETFs, Funds and Hybrids coverage.

- Access qualitative analyst research on more than 1,600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds, plus data on over 48,000 global securities

- Access our top equity picks, including sustainable dividend generating stocks, 5-star Australian and global stocks, 5-star Australian and global listed property stocks, sustainable investing stocks and more

- Easy-to-use, customisable filters to quickly identify investments which suit your goals

- Stock filter options include sector, market cap, dividend yield, franking percentage, payout ratio, Morningstar rating, economic moat, price/earnings ratio, return on equity, annualised return and more

- ETF and Fund filter options include yield, total cost ratio, annualised return, category, management style, Morningstar analyst rating, sustainability rating and more

- Keep an eye on price movements and Morningstar ratings as you wait for a more compelling opportunity with a customisable watchlist

No credit card needed.

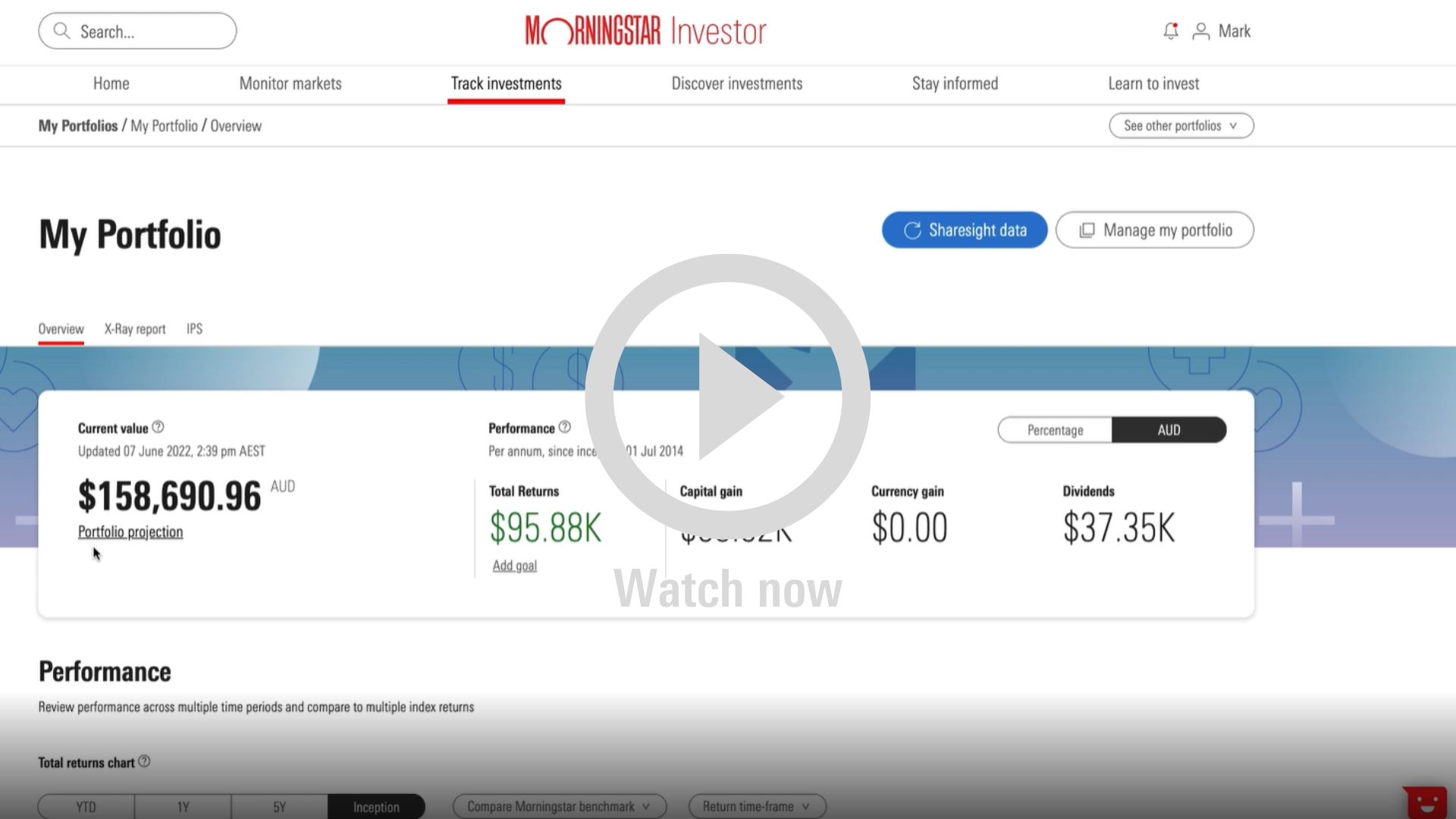

Track & analyse investments

Morningstar Investor includes complimentary access to Sharesight’s Standard Plan, one of Australia’s leading portfolio trackers (valued up to $372 p.a.) Sharesight’s integration into Morningstar Investor’s portfolio manager allows you to:

- Track all of your investments in a single location

- Easy dividend tracking with corporate actions automatically incorporated in portfolio reports

- An integration with Morningstar’s data and research: garner insights on your holdings from our team of equity and fund analysts

- Know your portfolio's true performance with daily price & currency updates

- Save time during tax time with streamline portfolio and tax reporting

- Know your exposure: Take a deep dive into your portfolio with Morningstar’s Portfolio X-Ray – get region, sector and style breakdowns

- Stay on top of your investments with email alerts for new corporate events, sudden movements in price, plus a weekly portfolio performance summary

No credit card needed.

Already a Sharesight user? We’ll pick up your bill (up to the value of the Standard Plan)

Monitor markets

We contextualise day to day market movements with our view of the overall market valuation so you can focus on the long-term investment opportunity.

- Explore index, commodity and currency changes

- See the current price to fair value of each market we cover along with the valuation from a year ago

Stay informed

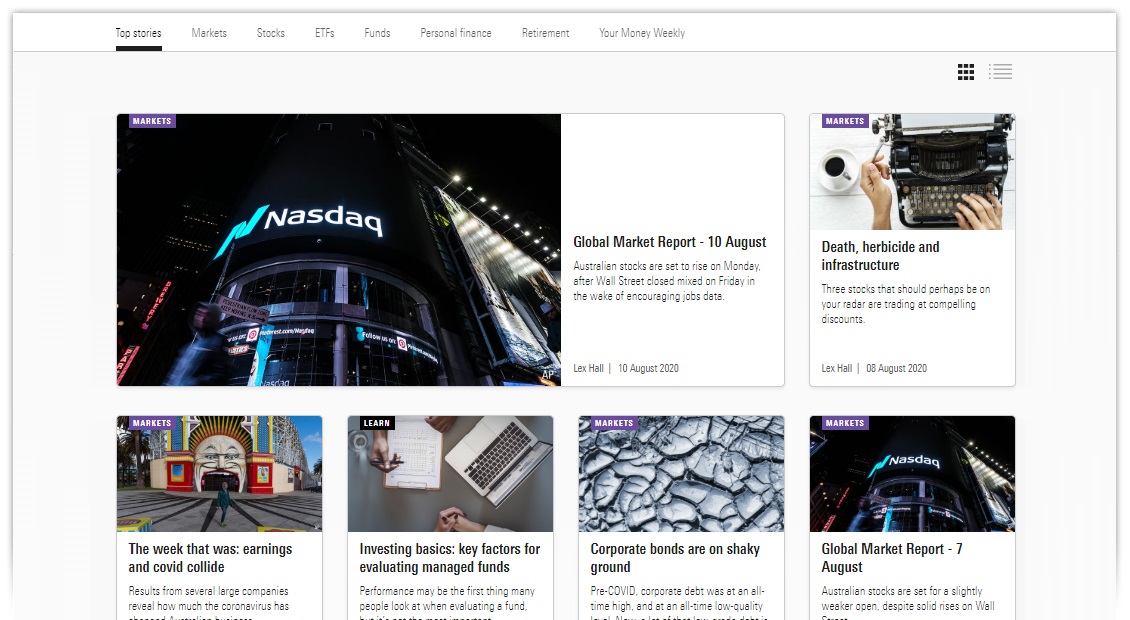

Our journalists in Australia, North America and Europe deliver insights from our wide breadth of equity, fund and ETF research, our in-house behavioural science researchers and our investment management team.

- A view on markets and investing focused on sound analysis rather than snap reactions to market events

- Access to our latest equity, fund and ETF research

- Commentary and insights on latest economic, political and business news

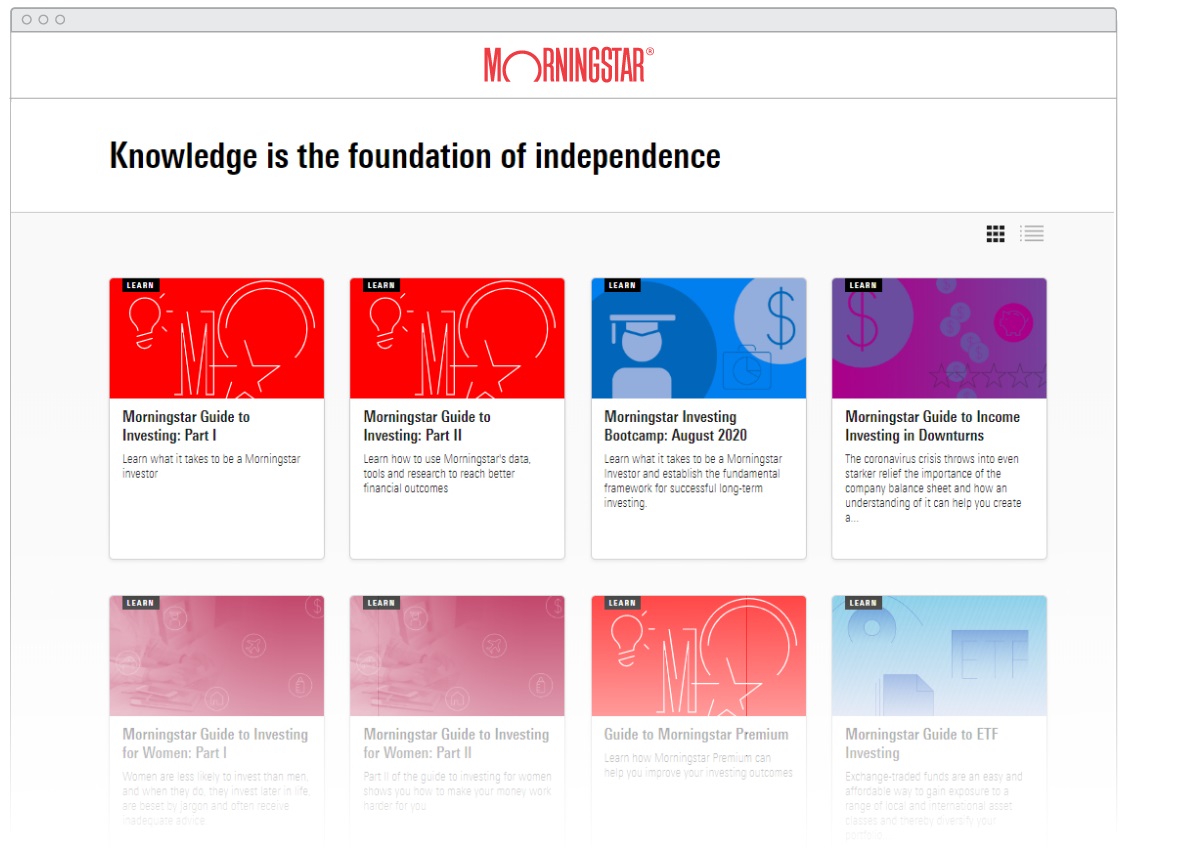

Learn to invest

Knowledge is the foundation of independence. As a Morningstar Investor member, you'll receive access to investing guides covering a wide range of topics. These are designed for both novice investors and experienced investors looking to review key foundational topics.

- Discover strategies to build wealth via stock, fund and ETF investing

- Learn fundamental frameworks for successful long-term investing

- How to build a portfolio aligned to your goals

No credit card required.

Frequently Asked Questions

➣ Why does Morningstar’s ratings on my broker platform differ from the ones in Morningstar Investor

The research that you receive through your Morningstar Investor Membership is qualitative—our analysts have rated the stock and provided input and opinion to the final fair value. The research that you access through your broker is quantitative in nature – what this means is that the fair value is decided based on data inputs and algorithms, without weigh in from our analysts.

This is why the research and ratings may differ between your membership and your broker.

Morningstar Investor is not a broker service – it offers a different service to your broker – focusing on providing investors a holistic portfolio management tool that helps you track, monitor and maintain your investments.

➣ I receive Morningstar ratings for free from my broker. How is this product different? What is the difference if I access it directly?

The level of access to Morningstar ratings and data differs broker to broker, but in most instances, the ratings that you receive free from your broker are quantitative in nature. This means that fair value (the long-term intrinsic value of a share) that is assigned to a share is calculated based on an algorithm. As part of Morningstar Investor, you receive access to qualitative analyst research on more than 1600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds.

Morningstar Investor is a holistic solution that is focused on the investor, and not the investment. It offers access to ratings, as mentioned, and data on over 48,000 securities. It also includes analyst insights and editorial thought leadership, including forecasts for ASX/200 stocks.

As part of your subscription, you also receive access to a Portfolio Manager that is powered by award winning Portfolio Tracker, Sharesight and integrated with Morningstar research and data. This is accompanied by a suite of tools and calculators to help investors reach their investing goals, including goal calculators, asset allocation models, ETF model portfolios and more.

➣ Is Morningstar Investor a broker service?

Morningstar Investor does not offer investors the ability to trade securities.

➣ What if I already have Sharesight subscription?

If you already have a Sharesight subscription, we will pick up your bill (up to the value of the Standard Plan). For existing Sharesight subscribers, you are able to link your existing account to your Investor subscription. If you are on the monthly Standard Plan, the billing will be directed to Morningstar from the following month. If you are on an annual plan, the next annual payment will be paid directly by Morningstar. If you are on a higher priced plan you will be charged the difference between the Standard Plan cost and your plan.

No credit card required.

^This offer is limited to new clients and cannot be used in combination with any other promotional offers and cannot be used to extend an existing Investor Membership. One free trial per household. Morningstar is licensed to provide our subscription service to Australian residents only.

© 2026 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This report has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or New Zealand wholesale clients of Morningstar Research Ltd, subsidiaries of Morningstar, Inc. Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

Legal Notices Privacy Policy Regulatory Disclosures Global Contacts