See Our Best Funds

Looking to buy funds? Screen 8,000+ funds and access detailed research and ratings to find our best rated funds meeting your criteria. Or view all our best fund ideas now inside Morningstar Investor.

No credit card needed.

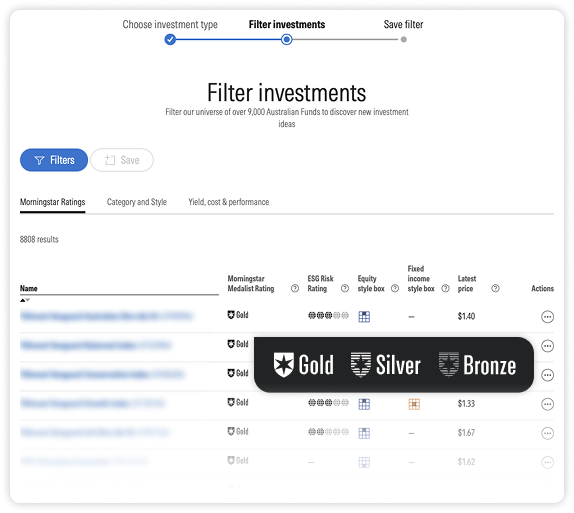

Screen 8,000+ funds to find our best rated funds meeting your criteria

Scan & filter over 8,000 Australian and global funds based on fund provider, Morningstar ratings, yield, cost, equity style, management style, past performance and more, with the Morningstar Investor fund screener.

Browse funds from Vanguard, Macquarie, Fidelity, Blackrock, Oaktree, State Street Global Advisors, AMP, Perpetual and much more.

Sign up for a FREE 4-week trial^ of Morningstar Investor now. No credit card needed.

Access all our best Australian & global fund ideas today

Fast-track the investment selection process and unlock our best-rated fund lists. These lists align with various investment strategies to help you achieve your specific investing goals.

Medalist Passive Australian Equity

Medalist Passive Global Equity

Medalist Income

Medalist Active Global Equity

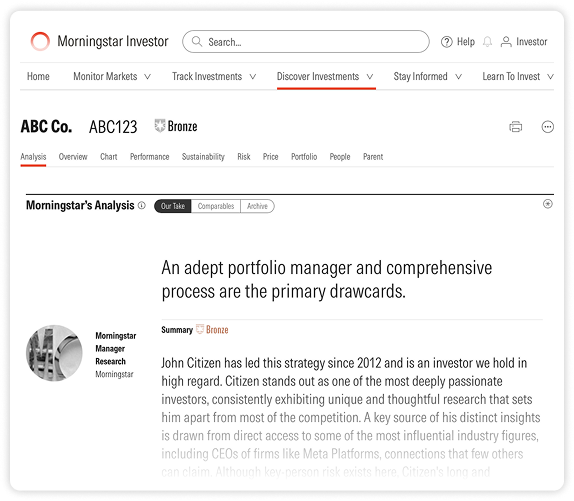

Dive deeper with detailed research reports

Access our fund research reports and see Morningstar medalist ratings and commentary on a fund’s investment process, team, performance, priorities & price. Then view top fund holdings, sector exposure, asset allocation and more.

Sign up for a FREE 4-week trial^ of Morningstar Investor now. No credit card needed.

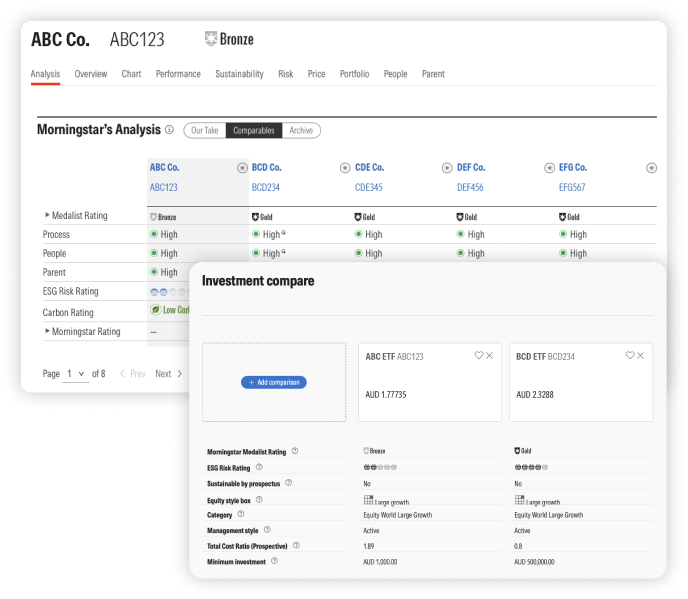

Compare funds

See the ‘Comparables’ section inside our research reports to see how a fund stacks up to similar funds or use the Compare tool to do a side-by-side comparison of funds you select.

Sign up for a FREE 4-week trial^ of Morningstar Investor now. No credit card needed.

About Morningstar’s fund rating methodology

The Morningstar Medalist Rating is a forward-looking, qualitative rating that helps investors find funds that are likely to outperform their peers over a full market cycle, after accounting for fees and risk, through a market cycle.

Medals (Gold, Silver, and Bronze) indicate that analysts expect a fund to outperform its peers over a full market cycle; Neutral and Negative ratings mean that analysts aren’t confident in a fund’s ability to do so.

A fund’s rating is based on an assessment of the fund managers’ approach to their investment strategy (Process), the individuals who manage the fund (People), and the asset manager that offers the fund (Parent). These pillar assessments also account for other factors like Price and Performance.

About Us

We’re all in for investors.

Morningstar is a leading source of independent investment research for stocks, funds, ETF's, credit, and LIC's as well as financial data, news, investing tools.

It started with an idea—one great idea from a 27-year-old stock analyst. Joe Mansueto thought it was unfair that people didn’t have access to the same information as financial professionals. So he hired a few people and set up shop in his apartment—to deliver investment research to everyone. We didn’t know then what the company would look like today, but we knew the commitment to our mission—to empower investor success—wouldn’t change. Now, we operate through wholly- or majority-owned subsidiaries in 32 countries. We’ve empowered investors all over the world, and we’re continuing to look for new ways to help people achieve financial security.

Our research is independent, which means we do not charge or accept payment or commissions from fund managers, listed companies or other product issuers to produce research on their products. Our mission remains true today, 39 years after that one great idea – we believe in the democratization of investment information, research and data. Our mission is at the core of everything we do – to empower investor success.

12,000+

employees

32

countries

48,000+

investments covered

Your FREE 4-week trial^ of Morningstar Investor gives you access to more than just our best fund ideas

Discover Investments

Find investment opportunities which fit your needs with our equities, ETFs, Funds and Hybrids coverage.

- Access qualitative analyst research on more than 1,600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds, plus data on over 48,000 global securities

- Access our top equity picks, including sustainable dividend generating stocks, 5-star Australian and global stocks, 5-star Australian and global listed property stocks, sustainable investing stocks and more

- Easy-to-use, customisable filters to quickly identify investments which suit your goals

- Stock filter options include sector, market cap, dividend yield, franking percentage, payout ratio, Morningstar rating, economic moat, price/earnings ratio, return on equity, annualised return and more

- ETF and Fund filter options include yield, total cost ratio, annualised return, category, management style, Morningstar analyst rating, sustainability rating and more

- Keep an eye on price movements and Morningstar ratings as you wait for a more compelling opportunity with a customisable watchlist

No credit card needed.

Track & analyse investments

Morningstar Investor includes complimentary access to Sharesight’s Standard Plan, one of Australia’s leading portfolio trackers (valued up to $464.04 p.a.) Sharesight’s integration into Morningstar Investor’s portfolio manager allows you to:

- Track all of your investments in a single location

- Easy dividend tracking with corporate actions automatically incorporated in portfolio reports

- An integration with Morningstar’s data and research: garner insights on your holdings from our team of equity and fund analysts

- Know your portfolio's true performance with daily price & currency updates

- Save time during tax time with streamline portfolio and tax reporting

- Know your exposure: Take a deep dive into your portfolio with Morningstar’s Portfolio X-Ray – get region, sector and style breakdowns

- Stay on top of your investments with email alerts for new corporate events, sudden movements in price, plus a weekly portfolio performance summary

No credit card needed.

Monitor markets

We contextualise day to day market movements with our view of the overall market valuation so you can focus on the long-term investment opportunity.

- Explore index, commodity and currency changes

- See the current price to fair value of each market we cover along with the valuation from a year ago

No credit card needed.

Stay informed

Our teams in Australia, North America and Europe deliver insights from our wide breadth of equity, fund and ETF research, our in-house behavioural science researchers and our investment management team.

- A view on markets and investing focused on sound analysis rather than snap reactions to market events

- Commentary and insights on latest economic, political and business news

- Access to our latest equity, fund and ETF research, including in-depth research reports

No credit card needed.

Learn to invest

Knowledge is the foundation of independence. Access to educational webinars and investing guides covering a wide range of topics. These are designed for both novice investors and experienced investors looking to review key foundational topics.

- Discover strategies to build wealth via stock, fund and ETF investing

- Learn fundamental frameworks for successful long-term investing

- How to build a portfolio aligned to your goals

No credit card needed.

Frequently Asked Questions

➣ Why does Morningstar’s ratings on my broker platform differ from the ones in Morningstar Investor

The research that you receive through your Morningstar Investor Membership is qualitative—our analysts have rated the stock and provided input and opinion to the final fair value. The research that you access through your broker is quantitative in nature – what this means is that the fair value is decided based on data inputs and algorithms, without weigh in from our analysts.

This is why the research and ratings may differ between your membership and your broker.

Morningstar Investor is not a broker service – it offers a different service to your broker – focusing on providing investors a holistic portfolio management tool that helps you track, monitor and maintain your investments.

➣ I receive Morningstar ratings for free from my broker. How is this product different? What is the difference if I access it directly?

The level of access to Morningstar ratings and data differs broker to broker, but in most instances, the ratings that you receive free from your broker are quantitative in nature. This means that fair value (the long-term intrinsic value of a share) that is assigned to a share is calculated based on an algorithm. As part of Morningstar Investor, you receive access to qualitative analyst research on more than 1600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds.

Morningstar Investor is a holistic solution that is focused on the investor, and not the investment. It offers access to ratings, as mentioned, and data on over 46,000 securities. It also includes analyst insights and editorial thought leadership, including forecasts for ASX/200 stocks.

As part of your subscription, you also receive access to a Portfolio Manager that is powered by award winning Portfolio Tracker, Sharesight and integrated with Morningstar research and data. This is accompanied by a suite of tools and calculators to help investors reach their investing goals, including goal calculators, asset allocation models, ETF model portfolios and more.

➣ Is Morningstar Investor a broker service?

Morningstar Investor does not offer investors the ability to trade securities.

➣ What if I already have Sharesight subscription?

If you already have a Sharesight subscription, we will pick up your bill (up to the value of the Standard Plan). For existing Sharesight subscribers, you are able to link your existing account to your Investor subscription. If you are on the monthly Standard Plan, the billing will be directed to Morningstar from the following month. If you are on an annual plan, the next annual payment will be paid directly by Morningstar. If you are on a higher priced plan you will be charged the difference between the Standard Plan cost and your plan.

No credit card required.

Investing in funds

New to investing in funds? Here are some helpful tips & information we advise beginner fund investors read.

A managed fund (or mutual fund) is a pooled investment vehicle—it combines money from multiple investors and purchases assets chosen by a professional manager. Pooling funds with other investors allows you to access professional managers, who in turn can put your money in varying asset classes which may be difficult for you to invest in directly. This approach may also diversify your risk, for example, if one asset class dips another will be there to pick up the slack.

The first managed fund was established in 1774 in the Netherlands. Known as Eendragt maakt magt—Dutch for ‘Unity Creates Strength’—the fund was created with the sole purpose of providing investors with smaller amounts of capital than institutions, thereby providing an opportunity to diversify and invest . This principle endures today with many managed funds offering retail investors the ability to pool their funds, and, under the aegis of professional managers, discover opportunities that were previously out of reach.

Following in the footsteps of the Dutch, Australia’s first managed fund opened in 1936. Taking as its motto ‘For Security’, it sought to provide Australians with a vehicle through which they could diversify their investments and earn a stable income. These days funds are even more accessible. The barriers to entry are lower. There are many points of access and a multitude of different investment types to choose from . And the scale of the industry has grown exponentially since its humble beginnings in the Netherlands.

In Australia, a key boost for the industry has come in the form of compulsory superannuation. Unless your superannuation is self-managed, it is likely that your account is held in a managed fund. Globally, Vanguard and BlackRock have emerged as the first pick in the fantasy football investing team, becoming goliaths of the industry with a focus on passive investing.

There are many reasons why investing in managed funds may help you achieve your financial goals.

A crucial benefit of managed funds is the ability to easily diversify your portfolio. Managed funds allow you to invest small amounts of cash across several funds and gain exposure to asset classes that may be difficult to directly access. This is one of the main reasons a managed fund may be a suitable first investment.

Managed funds allowed investors to access an investment vehicle run by a well resourced team dedicated to making calculated decisions about which asset classes, markets and sectors to invest in and when.

Pooling your cash with other investors may give you exposure to previously inaccessible opportunities and allows you to diversify your portfolio over potentially thousands of shares instead of individual equities.

Managed funds are professionally managed. This means that there is a professional team monitoring your investments and making decisions on your behalf. The responsibility to select investments is outsourced to a team that is focused on meeting the objectives outlined in the fund’s mandate. This frees you up to focus on constructing a portfolio that will help you achieve your long-term goals. We will talk about how Morningstar analysts assess the quality of the professional management a little further on.

Funds are convenient. After the initial application process or investment, there are few other steps to take to manage your investment, especially if you choose to reinvest your distributions (income that is paid from the fund at set intervals). Your fund should issue you a tax statement shortly after the end of financial year that will outline your tax obligations. Convenience is a key advantage for investing in funds. with automatic deposits generally available to enable you to set the amount and frequency of additional investments.

However, this may not be convenient for everyone. There is a lack of control over your investment and all decisions are made on your behalf. To make matters a little worse, it is an industry standard to disclose only the top 5 (or top 10, if you’re lucky) holdings in the funds. This lack of visibility and control is a disadvantage that investors in direct equities don’t face. They can view their portfolio in its entirety and execute trades when they please.

Fees can have a large impact on your investment returns and your ability to meet your financial goals. Fund costs can vary drastically depending on the management and investment style. Understanding the fees you are paying for the management of the fund is crucial.

Performance is not guaranteed. Some assets (such as high interest savings accounts, bonds and annuities) have fixed returns that add a level of certainty to your investment outcome. Managed funds do not offer guaranteed performance and returns can vary greatly, making it difficult to predict investment or income.

Although a large advantage of managed funds is taxation and consolidated reporting, tax itself can be an issue, especially in Australia. You’ll be taxed on the gains made from the manager selling individual holdings, regardless of whether you decide to withdraw from the fund.

Buying a managed fund is a lot like going in on a group gift or joining a co-op, allowing investors to combine their cash and buy the expertise of a professional stock picker. By pooling their money together, managed fund investors can invest in a much broader range of stocks or bonds than they could if they were trying to go it alone – either because it would be too expensive, or certain assets are not available for sale to individual investors.

Want some help? Ask your adviser

If you feel unsure about the process or want some help selecting the right fund for you, a financial adviser can help you select the right options to help you achieve your personal investing goals.

Financial advisers often use a digital investment platform to organise their clients’ investments and purchase managed funds. Asset managers create funds which are sold via these platforms.

The advantages of working with an adviser are clear: You have someone helping you make sometimes complex financial decisions, taking care of paperwork for you, monitoring fund performance, and encouraging you to stick to your investment time horizon instead of cashing in for an around-the-world jaunt or bailing when the market crashes.

However, this service isn't free. If you work with an adviser, you'll have to pay a fee, either a fixed amount based on hours worked, or a percentage of your invested money.

Be aware that managed funds recommended by an adviser will be part of their approved product list and purchased via the platform the firm uses. This means that if you want to buy a fund which doesn't appear on the list, or via the selected third-party platform, the adviser may have trouble assisting you in purchasing it.

Another challenge is finding an adviser with whom you work well, and understands your risk tolerance and financial dreams. It is also important to find one who matches your appetite for involvement – do you want to totally outsource, or find an adviser who is willing to take the time to teach you about investing and your portfolio?

Go it alone – direct investment

If you find yourself with the time and inclination to take total control of your investments, you can choose to go it alone without the help of an adviser. While DIY investing can be rewarding, it is not a simple process.

Buying units in a managed fund can be done directly via a paper application form – this means downloading the form via the asset managers website, printing it, filling it in, signing it and sending it via snail mail.

The forms themselves are also a challenge. Details required include personal details – name, age, address, the provision of identification documentation – drivers' licence, passport, taxation information, and the provision of signatures and declarations.

All copies of identification documents you provide must be certified a person authorised to do so.

In terms of payment, while there isn't a standardised process, most asset managers accept cheque or direct credit transfer.

Some asset managers allow investors to apply to invest online, but after you've filled it out online you need to print, date and sign it, and send it back. Newer direct to consumer products are fully automated, using digital processing and verification to speed up the application process.

But, there are several advantages to going it alone. Firstly, you won't have to pay an adviser for making the purchase on your behalf – or, which can be more galling, in times when there is no trading activity. Secondly, doing it yourself means you'll be afforded complete transparency and knowledge of your transactions and holdings.

With numerous managed funds domiciled in Australia, the task of choosing a fund your portfolio can be intimidating.

It's tempting to visit a website like Morningstar and just pick the top performing fund. But while performance is important, there are other things to consider when selecting a fund. You need to make sure you pick one which suits your investment goals, portfolio and personality.

Here are five questions to consider as you approach the marketplace of managed funds. These are based on the five pillars that Morningstar analysts themselves rate a fund on; known as the ‘five ps’.

PEOPLE: Who is running the fund?

Typically, an investment management firm is made of two key groups of people – portfolio managers who make investment decisions, and a team of research analysts who provide research and input to the portfolio managers. Each analyst will usually have a specific sector expertise such as consumer or healthcare stocks, or regional knowledge. In some funds there may be more than one portfolio manager operating a collegiate approach, in others, often smaller mandates, there will be a sole fund manager.

One person can change the course of history, or the direction of a fund. It's important to know who calls the shots – and how long they've been doing it. Delve into the manager's history to see how they've done during times of volatility, such as the 2008 downturn. While not essential, it's a good sign if the manager who founded the fund is still the one in charge. Look for someone you think you can trust to manage your money, and whose investment philosophy you believe in.

PROCESS: What is the investment strategy?

The types of assets a managed fund invests in gives us a clue about risk and performance. Are they investing in stocks, bonds, both? In Australian equities, developed markets, or emerging markets? Big companies or small companies? These asset classes and regions each have different characteristics and you should expect them to perform differently.

Each fund's investment strategy is important to deciding whether the fund is right for you and your investing personality. Some managed funds take a growth approach, loading up on high-priced companies that are growing quickly, or a value approach, favouring stocks with lower earnings prospects but cheap prices. Others use a broadly diversified portfolio with hundreds of holdings, while others focus in on just a few dozen names known as a concentrated portfolio.

The best way to familiarise yourself with a fund's strategy is by reading their product disclosure statement. Make sure you're comfortable with the risk level, volatility and the approach. Each quarter you should also get a feel of how the investment management team is feeling about the market, and how they intend to position the portfolio.

Remember, before you invest you should consider how the fund fits into your larger portfolio. And consistency is key. Inconsistency costs you cash.

PRICE: How much does the fund charge?

Managed funds aren't free. That's because there is a team of people managing your money –researching, analysing and picking stocks. You should pay for professional management if you need it but remember every dollar you give to fund management is a dollar you take away from your own return.

So how can you discover whether you're paying too much? Pay attention to the fund's ongoing fees which will be listed on their product disclosure statement. Compare how the fund's fees compare with other similar funds.

PERFORMANCE: How has the fund performed?

If you're shelling out for an active management, you expect the fund to deliver a good return. However, it's not always useful to turn to a 'top performing funds' list for direction about who to invest in. While most people would assume a fund which returns 10 per cent is better than a fund that returned 5 per cent, that's not necessarily the case. The fund that gained 5 per cent may have beaten competing funds that follow the same investment style, while the 10 per cent fund may have lagged its direct competitors.

To really get a sense of how well a fund is doing, put the fund's returns into context. Compare the fund's returns to the appropriate benchmark – to indexes and to other funds that invest in the same types of assets with the same investment style.

PARENT: Who is the asset manager?

A managed fund's parent company is a lesser known but an important component of success. A parent company is the asset management firm. It's important because the quality of the parent company will give you a good indication of the strength and integrity of the people running the money.

A good parent company is one which retains and has a diverse staff and rigorous internal processes. They are willing to close the funds to new money when they grow too big to execute their strategies effectively – and merge those which have grown too small to deliver. An as investor, you want a company that emphasises good employee culture, drives down costs, provides stability and puts investors first.

See Morningstar’s best fund ideas now

Whether you are buying your first fund or managing a diversified portfolio, unlock all our best fund picks, research, ratings & tools with a FREE 4-week trial^ of Morningstar Investor.

No credit card required.

^The free 4-week trial offer is limited to new clients and cannot be used to extend an existing Investor Membership. One free trial per household. Morningstar is licensed to provide our subscription service to Australian residents only.

Financial investment involves the risk of loss.

© 2025 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This report has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or New Zealand wholesale clients of Morningstar Research Ltd, subsidiaries of Morningstar, Inc. Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

Legal Notices Privacy Policy Regulatory Disclosures Global Contacts