See Our Best ETFs

Looking to buy ETFs? Screen 400+ ETFs listed on the ASX and access detailed research and ratings to find our best rated ETFs meeting your criteria. Or view all our best ETF ideas now inside Morningstar Investor.

No credit card needed.

Screen 400+ ETFs to find our best rated ETFs meeting your criteria

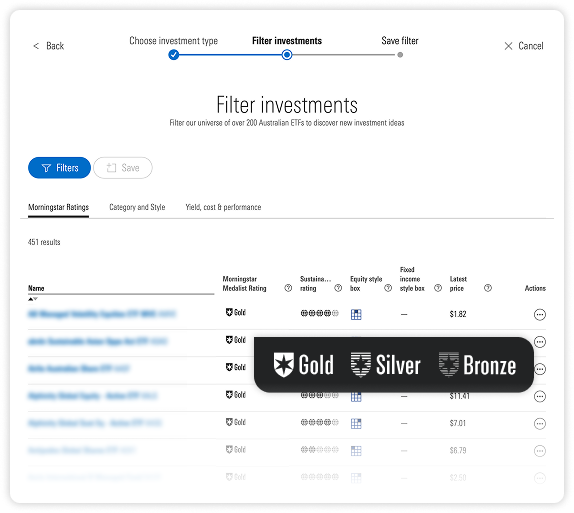

Scan & filter over 400 Australian and global ETFs listed on the ASX based on Morningstar ratings, yield, cost, equity style, management style, past performance and more, with the Morningstar Investor ETF screener.

Whether you are looking to get exposure to growth trends like artificial intelligence (AI), sectors like mining, specific markets like the US or emerging markets, or broad market indexes like the S&P 500 – Morningstar Investor can help.

Sign up for a FREE 4-week trial^ of Morningstar Investor now. No credit card needed.

Access all our best Australian & Global ETF ideas today

Fast-track the investment selection process and unlock our best-rated ETF lists. These lists align with various investment strategies to help you achieve your specific investing goals.

Medalist Passive Australian Equity

Medalist Passive Global Equity

Medalist Income

Medalist Active Global Equity

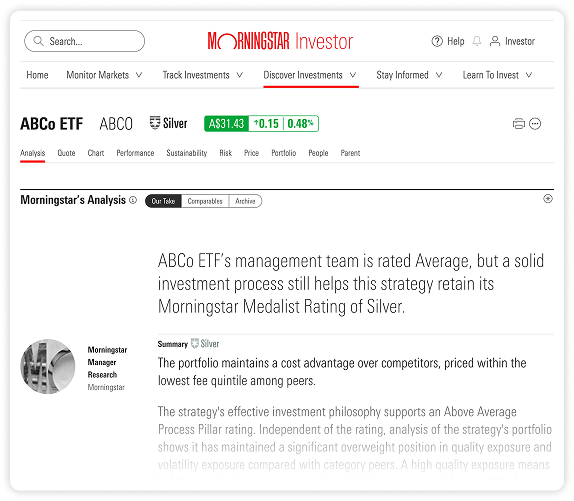

Dive deeper with detailed research reports

Access our ETF research reports and see Morningstar medalist ratings and commentary on a fund’s investment process, team, performance, priorities & price. Then view top fund holdings, sector exposure, asset allocation and more.

Sign up for a FREE 4-week trial^ of Morningstar Investor now. No credit card needed.

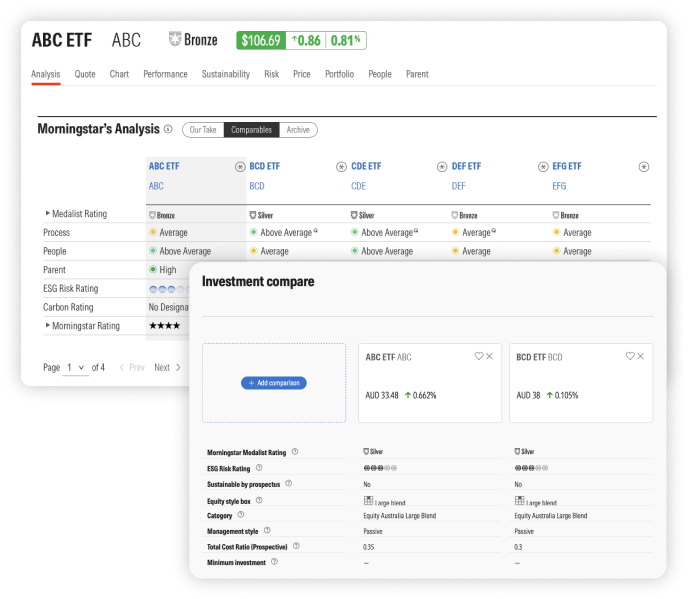

Compare ETFs

See the ‘Comparables’ section inside our research reports to see how an ETF stacks up to similar ETFs or use the Compare tool to do a side-by-side comparison of ETFs you select.

Sign up for a FREE 4-week trial^ of Morningstar Investor now. No credit card needed.

About Morningstar’s ETF rating methodology

The Morningstar Medalist Rating is a forward-looking, qualitative rating that helps investors find funds that are likely to outperform their peers over a full market cycle, after accounting for fees and risk, through a market cycle.

Medals (Gold, Silver, and Bronze) indicate that analysts expect an ETF to outperform its peers over a full market cycle; Neutral and Negative ratings mean that analysts aren’t confident in a fund’s ability to do so.

An ETF’s rating is based on an assessment of the fund managers’ approach to their investment strategy (Process), the individuals who manage the fund (People), and the asset manager that offers the fund (Parent). These pillar assessments also account for other factors like Price and Performance.

About Us

We’re all in for investors.

Morningstar is a leading source of independent investment research for stocks, funds, ETF's, credit, and LIC's as well as financial data, news, investing tools.

It started with an idea—one great idea from a 27-year-old stock analyst. Joe Mansueto thought it was unfair that people didn’t have access to the same information as financial professionals. So he hired a few people and set up shop in his apartment—to deliver investment research to everyone. We didn’t know then what the company would look like today, but we knew the commitment to our mission—to empower investor success—wouldn’t change. Now, we operate through wholly- or majority-owned subsidiaries in 32 countries. We’ve empowered investors all over the world, and we’re continuing to look for new ways to help people achieve financial security.

Our research is independent, which means we do not charge or accept payment or commissions from fund managers, listed companies or other product issuers to produce research on their products. Our mission remains true today, 39 years after that one great idea – we believe in the democratization of investment information, research and data. Our mission is at the core of everything we do – to empower investor success.

12,000+

employees

32

countries

48,000+

investments covered

Your FREE 4-week trial^ of Morningstar Investor gives you access to more than just our best ETF picks

Discover Investments

Find investment opportunities which fit your needs with our equities, ETFs, Funds and Hybrids coverage.

- Access qualitative analyst research on more than 1,600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds, plus data on over 48,000 global securities

- Access our top equity picks, including sustainable dividend generating stocks, 5-star Australian and global stocks, 5-star Australian and global listed property stocks, sustainable investing stocks and more

- Easy-to-use, customisable filters to quickly identify investments which suit your goals

- Stock filter options include sector, market cap, dividend yield, franking percentage, payout ratio, Morningstar rating, economic moat, price/earnings ratio, return on equity, annualised return and more

- ETF and Fund filter options include yield, total cost ratio, annualised return, category, management style, Morningstar analyst rating, sustainability rating and more

- Keep an eye on price movements and Morningstar ratings as you wait for a more compelling opportunity with a customisable watchlist

No credit card needed.

Track & analyse investments

Morningstar Investor includes complimentary access to Sharesight’s Standard Plan, one of Australia’s leading portfolio trackers (valued up to $464.04 p.a.) Sharesight’s integration into Morningstar Investor’s portfolio manager allows you to:

- Track all of your investments in a single location

- Easy dividend tracking with corporate actions automatically incorporated in portfolio reports

- An integration with Morningstar’s data and research: garner insights on your holdings from our team of equity and fund analysts

- Know your portfolio's true performance with daily price & currency updates

- Save time during tax time with streamline portfolio and tax reporting

- Know your exposure: Take a deep dive into your portfolio with Morningstar’s Portfolio X-Ray – get region, sector and style breakdowns

- Stay on top of your investments with email alerts for new corporate events, sudden movements in price, plus a weekly portfolio performance summary

No credit card needed.

Monitor markets

We contextualise day to day market movements with our view of the overall market valuation so you can focus on the long-term investment opportunity.

- Explore index, commodity and currency changes

- See the current price to fair value of each market we cover along with the valuation from a year ago

No credit card needed.

Stay informed

Our teams in Australia, North America and Europe deliver insights from our wide breadth of equity, fund and ETF research, our in-house behavioural science researchers and our investment management team.

- A view on markets and investing focused on sound analysis rather than snap reactions to market events

- Commentary and insights on latest economic, political and business news

- Access to our latest equity, fund and ETF research, including in-depth research reports

No credit card needed.

Learn to invest

Knowledge is the foundation of independence. Access to educational webinars and investing guides covering a wide range of topics. These are designed for both novice investors and experienced investors looking to review key foundational topics.

- Discover strategies to build wealth via stock, fund and ETF investing

- Learn fundamental frameworks for successful long-term investing

- How to build a portfolio aligned to your goals

No credit card needed.

Frequently Asked Questions

➣ Why does Morningstar’s ratings on my broker platform differ from the ones in Morningstar Investor

The research that you receive through your Morningstar Investor Membership is qualitative—our analysts have rated the stock and provided input and opinion to the final fair value. The research that you access through your broker is quantitative in nature – what this means is that the fair value is decided based on data inputs and algorithms, without weigh in from our analysts.

This is why the research and ratings may differ between your membership and your broker.

Morningstar Investor is not a broker service – it offers a different service to your broker – focusing on providing investors a holistic portfolio management tool that helps you track, monitor and maintain your investments.

➣ I receive Morningstar ratings for free from my broker. How is this product different? What is the difference if I access it directly?

The level of access to Morningstar ratings and data differs broker to broker, but in most instances, the ratings that you receive free from your broker are quantitative in nature. This means that fair value (the long-term intrinsic value of a share) that is assigned to a share is calculated based on an algorithm. As part of Morningstar Investor, you receive access to qualitative analyst research on more than 1600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds.

Morningstar Investor is a holistic solution that is focused on the investor, and not the investment. It offers access to ratings, as mentioned, and data on over 46,000 securities. It also includes analyst insights and editorial thought leadership, including forecasts for ASX/200 stocks.

As part of your subscription, you also receive access to a Portfolio Manager that is powered by award winning Portfolio Tracker, Sharesight and integrated with Morningstar research and data. This is accompanied by a suite of tools and calculators to help investors reach their investing goals, including goal calculators, asset allocation models, ETF model portfolios and more.

➣ Is Morningstar Investor a broker service?

Morningstar Investor does not offer investors the ability to trade securities.

➣ What if I already have Sharesight subscription?

If you already have a Sharesight subscription, we will pick up your bill (up to the value of the Standard Plan). For existing Sharesight subscribers, you are able to link your existing account to your Investor subscription. If you are on the monthly Standard Plan, the billing will be directed to Morningstar from the following month. If you are on an annual plan, the next annual payment will be paid directly by Morningstar. If you are on a higher priced plan you will be charged the difference between the Standard Plan cost and your plan.

No credit card required.

Investing in ETFs

New to investing in ETFs? Here are some helpful tips & information we advise beginner ETF investors read.

An exchange-traded fund, or ETF, is a collection of investments that trade just like a stock on an exchange.

ETFs are commonly used get returns similar to a specific market index. For example, you could invest in an ETF that mimic its movements of the S&P/ASX 200.

Most ETFs are passively managed. Managers who oversee passive ETFs will take a hands-off approach, simply ensuring that their ETFs replicate their designated indices. A manager will not intervene if an index takes a turn for the worse. In other words, the manager is being passive.

Today, there is a wide variety of passive ETFs in the Australian market. There are those which track segments of the local sharemarket like VAS. Then there are others that track global—developed and emerging—markets, such as the S&P500 Index. Newer ETFs now provide exposure to a single commodity or a basket of commodities.

A handful of active ETFs are also available to investors.

Active ETFs are run by a manager or a management team that attempts to outperform their designated index. But outperformance is not guaranteed; sometimes an ETF can do better than its index, but sometimes it can do worse.

The share price for an ETF is based on the net asset value (or NAV) of the underlying stocks the ETF tracks. An ETF typically trades at prices that match this NAV closely. However, ETFs may trade at prices above or below their NAV, as ETFs are subject to supply and demand. These price deviations should, however, be relatively short-lived, as they create arbitrage opportunities which may be exploited by other market participants.

Advantages

- Exchange-traded funds are an easy and affordable way to gain exposure to a range of local and international asset classes and thereby diversify your portfolio.

Disadvantages

- The ease of trading ETFs can encourage two of the main ways that investors get in trouble: 1) Chasing returns and investing in a new hot stock or sector 2) Exiting the market during downturns.

Like any stock, an exchange-traded fund has two prices: a bid and an ask, the prices at which you can sell and buy shares, respectively. The difference between the two is called the bid-ask spread, or spread. It is the transaction cost of buying then immediately selling a security (a round-trip trade). The spread compensates market-makers for the costs and risks they bear for keeping shares on hand.

In general, the narrower the spread, the more liquid an ETF is said to be. Liquidity is the ability of an asset to be traded without significantly moving the price and with minimal loss of value.

All but the most-liquid ETFs should be traded with limit orders, which specify a transaction price. Because of the in-kind creation/redemption mechanism discussed earlier, the true liquidity of an ETF is not determined by its asset size or its secondary market trading volume, but the liquidity of its underlying holdings. However, much of that liquidity may not be visible in the order book, which lists the number of shares and prices investors are willing to transact in a security at a given time. A limit order will often draw out hidden liquidity, making it cheaper to transact the ETF than the order book implies.

Horrible things can happen if you use market orders. They can “eat through” the order book of a less- liquid ETF before market-makers can react, creating big price swings. ETFs can also experience rare “flash crashes,” where their prices suddenly drop due to the withdrawal of liquidity by market-makers.

There are numerous ETFs listed on the ASX. There are ETFs that give you exposure broad market indexes, while others offer exposure to niche sectors such as cybersecurity. ETFs now also offer exposures to a variety of investment strategies such as active management and smart beta.

With so many ETFs choose from, how do you know which is the best for your portfolio?

Morningstar evaluates over 400 ETFs trading on the ASX and identify those they think will be able to outperform in years to come. This includes ETFs from popular ETF providers in Australia such as Vanguard Investments Australia, iShares, BetaShares Capital, State Street Global Advisors (AUS) and VanEck Investments. Analysts also cover Active ETFs from providers AMP Capital, Schroders, and Antipodes and more.

Costs – explicit costs like the expense ratio, and implicit costs like the cost of portfolio turnover – are paramount in running an index fund. Top-rated funds are among the lowest cost options in their category, relative to their actively and passively managed peers.

But costs are just one component of Morningstar's assessment of ETFs. Analysts scrutinise their performance relative to others in the category, both active and passive.

For passive products, analysts examine the fund's process – that is how the ETF are constructed, their underlying benchmarks, and the systems managers have put in place to achieve precise tracking of the benchmark.

Analysts also tend to favour parent firms that put investors' interest ahead of commercial goals, and monitor how the ETF is trading on the exchange. ETFs sometimes trade with wider than normal bid/ask spreads, or deviate substantially from their net asset value, or NAV, which can jack up the cost to investors.

Other issues considered by analysts:

- The amount of experience the team has in managing ETFs

- Rules dictating the balancing and reconstruction of the fund's benchmark

- Portfolio management approach – for examples full or synthetic replication

- Tracking issues that might arise

- How portfolio managers attempt to minimise trading costs

- The fund's distribution policy

- Firm's overall levels of transparency

- Firm's product development philosophy and its track record of launching new funds and shuttering unsuccessful ones

Medallist ratings are accompanied by the “analysts take” on the ETF – which includes their views on its suitability for investors, portfolio construction, fee and alternatives to consider.

Sign up for a FREE 4-week trial^ of Morningstar Investor to unlock access to our full list of:

- Medalist Australian equity ETFs

- Medalist global equity ETFs

- Medalist Australian listed property ETFs

- Medalist global property ETFs

- Medalist emerging market equity ETFs

- Medalist Australian fixed income ETFs

- Medalist global fixed interest ETFs

- Medalist global fixed infrastructure ETFs

No credit card required.

Use the Morningstar ETF screener to find the best ETFs

Morningstar's new Investor website helps filter the universe of over 400 ASX-listed ETFs to discover Morningstar's top-rated ETFs. By using the ETF Screener tool, you can quickly compile and save a list of Gold, Silver and Bronze-rated ETFs across several asset classes.

You can screen by the following criteria:

- Fund management company

- Asset class

- Management style (active or passive)

- Morningstar analyst rating

- Dividend yield

- Management fee

- Total return

Sign up for a FREE 4-week trial^ of Morningstar Investor to unlock access to the Morningstar ETF screener. No credit card required.

1) Use limit orders

Use limit orders when trading ETFs. Investors tend to use market orders in instances where time is of the essence and price is of secondary importance.

Investors using market orders want to execute their entire order as soon as possible. For very large, very liquid ETFs that trade contemporaneously with their underlying securities, like SPDR S&P 500 ETF (SPY)*, market orders will likely result in fast execution at a good price.

But most of the 2400-plus exchange-traded products on the market are smaller and less liquid than SPY and its ilk and may also trade out of sync with their constituent securities.

In all cases, using limit orders is good practice. Limit orders will ensure favorable execution from a price perspective.

A buy limit order will fetch the buyer a price less than or equal to the limit price, while a sell limit order will transact at a price greater than or equal to the limit price.

What is the potential cost of using limit orders? Time and incomplete execution. That is, it may take longer for a limit order to be filled than a market order, and when that time comes it might not be completely filled.

These costs need to be weighed against the cost of being exploited by an opportunistic market maker looking to pick off market orders in thinly traded ETFs.

2) Trade when the underlying market is open

If you are trading an ETF that invests in securities that trade in markets outside the United States, it's best to trade the associated ETF when its constituents are actively changing hands in their home market.

For example, it would be best to trade Vanguard FTSE Europe ETF (VGK) during the morning while European markets are still open.

During these overlapping trading hours, it is easier for market makers to keep VGK's price in line with its NAV, as the stocks in its portfolio are still being bought and sold in real time across Europe.

Once European markets close, market makers rely on the fluctuations of the US market as a guide in setting prices, an inherently less-reliable touchstone.

Of course, some markets that are tracked by US-listed ETFs have zero overlap with US trading hours, like Japan. Investors trading ETFs like iShares MSCI Japan ETF (EWJ) should see tip No 1 above.

3) Don't trade near the open - or the close, for that matter

It's best to avoid trading ETFs just after the opening bell: ETFs may take a while to "wake up" in the morning. For a variety of reasons, it takes some time for all of the securities in their portfolios to begin trading.

Before all of an ETF's constituents are trading, market makers may demand wider spreads as compensation for price uncertainty.

It's also a good idea to avoid trading ETFs as the closing bell approaches. As the market winds down toward day's end, many market makers step back from the markets to limit their risk headed into the close. At this point, spreads tend to widen as there are fewer actors actively quoting prices.

In light of these considerations, it makes sense to wait about 30 minutes after the opening bell to trade an ETF and to avoid trading during the half hour leading into the market's close.

4) If you're making a big trade, phone a friend

For investors looking to execute a large trade in an ETF, it makes sense to engage the help of a professional. There is no hard-and-fast definition as to what qualifies as a large trade.

General rules of thumb would place any trade that accounts for 20 per cent of an ETF's average daily volume or more than 1 per cent of its assets under management as fitting this description.

In these cases, investors can potentially save themselves substantial execution costs at the expense of spending some time on the phone with a representative of an ETF provider's capital markets team and/or a market maker.

5) If you don't need to trade, buy a mutual fund

ETFs aren't for everyone. With investment minimums for many index mutual funds and ETF trading commissions having been zeroed out in recent years, the choice between an ETF and an index fund that track identical benchmarks can now be boiled down to matters of personal preference and circumstance.

If you place no value on intraday liquidity, and you would prefer to forgo navigating the ins and outs of ETF trading, then an index mutual fund tracking the same benchmark is likely a better choice for you.

*ETFs mentioned in this article are US-listed products

This article was originally published on Morningstar.com and has been amended since original publication.

See Morningstar’s best ETF ideas now

Whether you are buying your first ETF or managing a diversified portfolio, unlock all our best ETF picks, research, ratings & tools with a FREE 4-week trial^ of Morningstar Investor.

No credit card required.

^The free 4-week trial offer is limited to new clients and cannot be used to extend an existing Investor Membership. One free trial per household. Morningstar is licensed to provide our subscription service to Australian residents only.

Financial investment involves the risk of loss.

© 2025 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This report has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or New Zealand wholesale clients of Morningstar Research Ltd, subsidiaries of Morningstar, Inc. Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

Legal Notices Privacy Policy Regulatory Disclosures Global Contacts