Searching for the best dividend ETF to buy for your portfolio?

Dividend ETFs

Screen over 300 ETFs and find dividend ETFs with the best yield meeting your criteria. View our ETF ratings and research reports, compare popular ETFs and more with Morningstar Investor.

No credit card required.

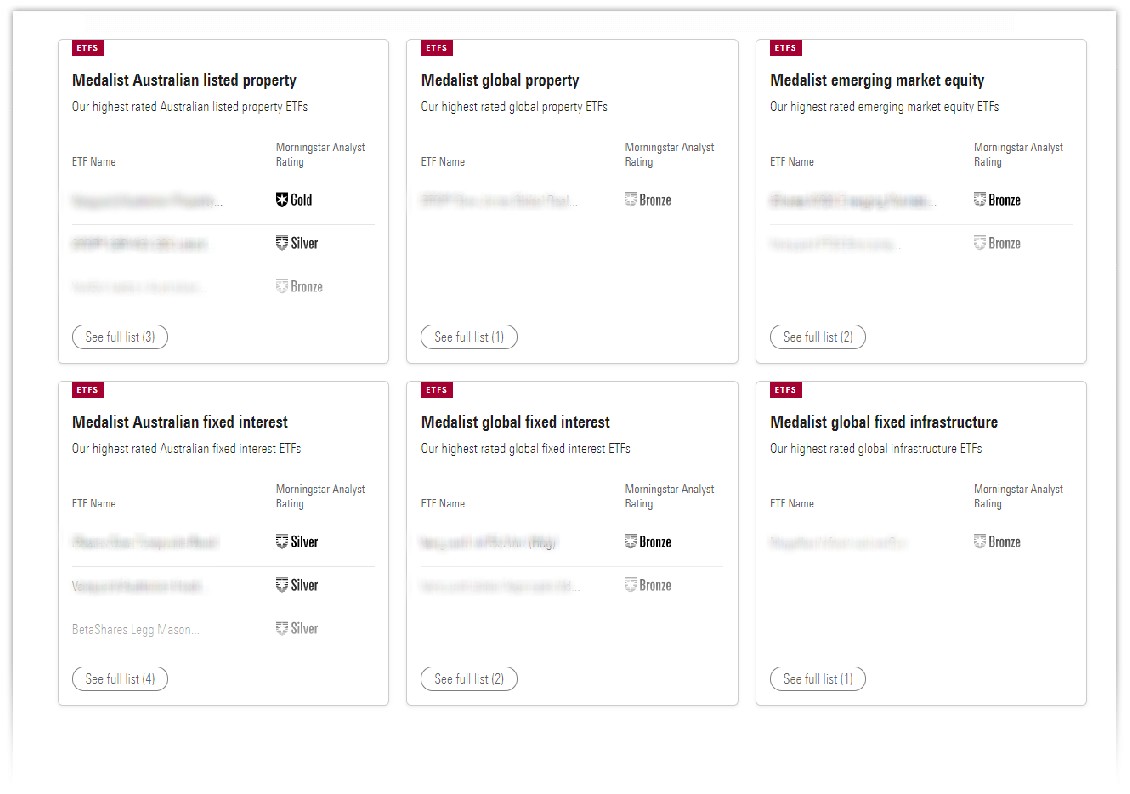

Unlock all our ETF ratings and research with Morningstar Investor

View all our best-rated ETFs

See our best rated passive and actively managed equity, property, fixed interest, infrastructure, sustainable ETFs.

No credit card required.

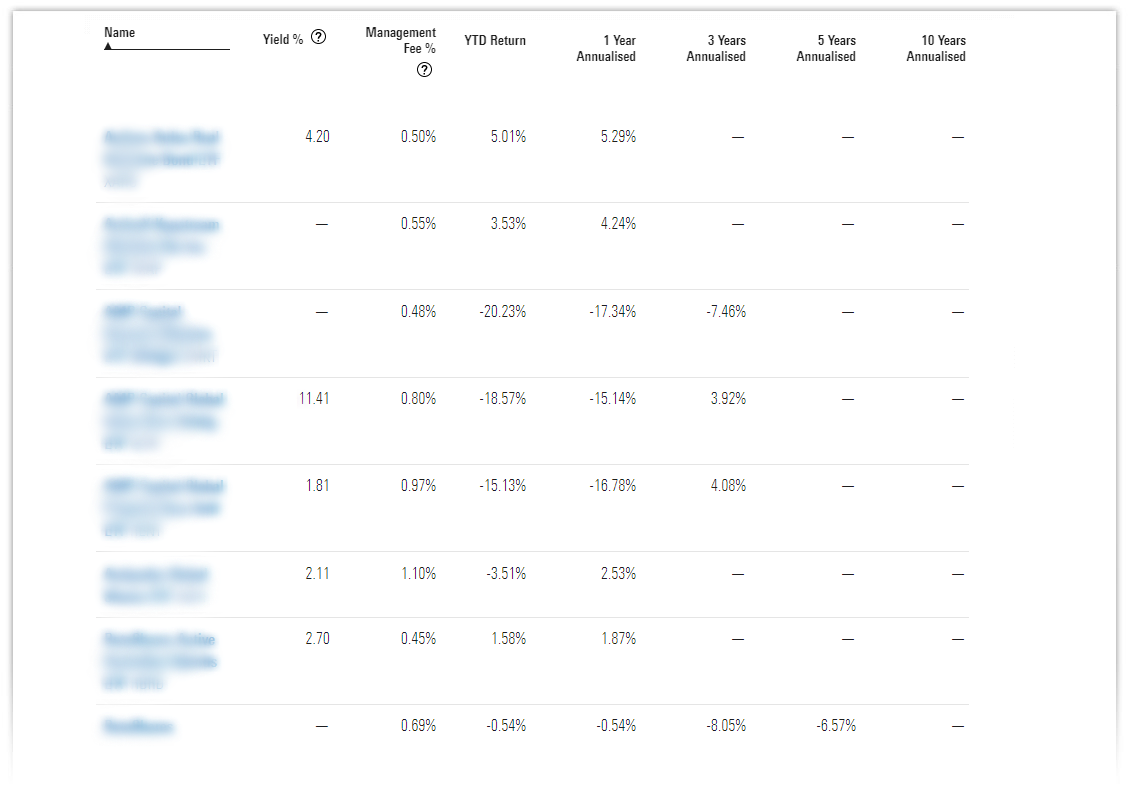

Compare ETFs

Screen over 300 ETFs - including dividend ETFs, shortlist your favourite, and compare to find the best ETF to meet your investment criteria, using the Morningstar Investor premium ETF screener.

No credit card required.

About Us

We’re all in for investors.

Morningstar is a leading source of independent investment research for stocks, funds, ETF's, credit, and LIC's as well as financial data, news, investing tools.

It started with an idea—one great idea from a 27-year-old stock analyst. Joe Mansueto thought it was unfair that people didn’t have access to the same information as financial professionals. So he hired a few people and set up shop in his apartment—to deliver investment research to everyone. We didn’t know then what the company would look like today, but we knew the commitment to our mission—to empower investor success—wouldn’t change. Now, we operate through wholly- or majority-owned subsidiaries in 32 countries. We’ve empowered investors all over the world, and we’re continuing to look for new ways to help people achieve financial security.

Our research is independent, which means we do not charge or accept payment or commissions from fund managers, listed companies or other product issuers to produce research on their products. Our mission remains true today, 39 years after that one great idea – we believe in the democratization of investment information, research and data. Our mission is at the core of everything we do – to empower investor success.

Your FREE 4-week trial^ of Morningstar Investor Gives You Access To More Than Just Our ETF Ratings & Research

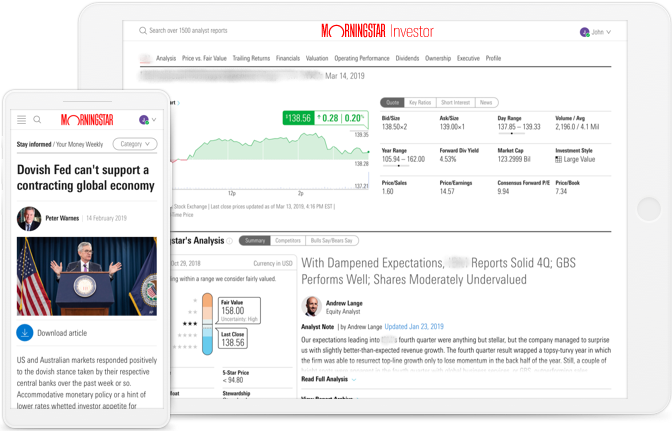

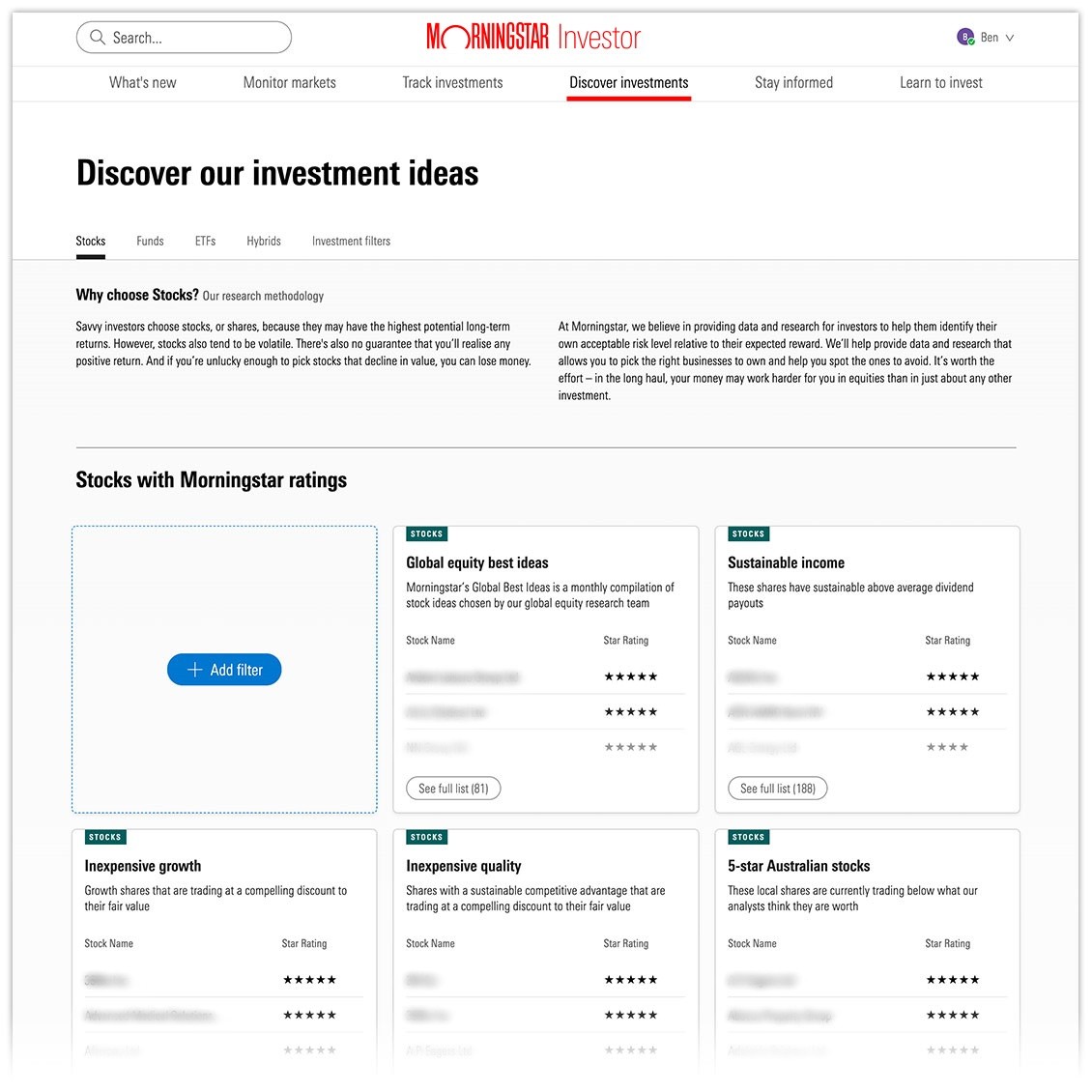

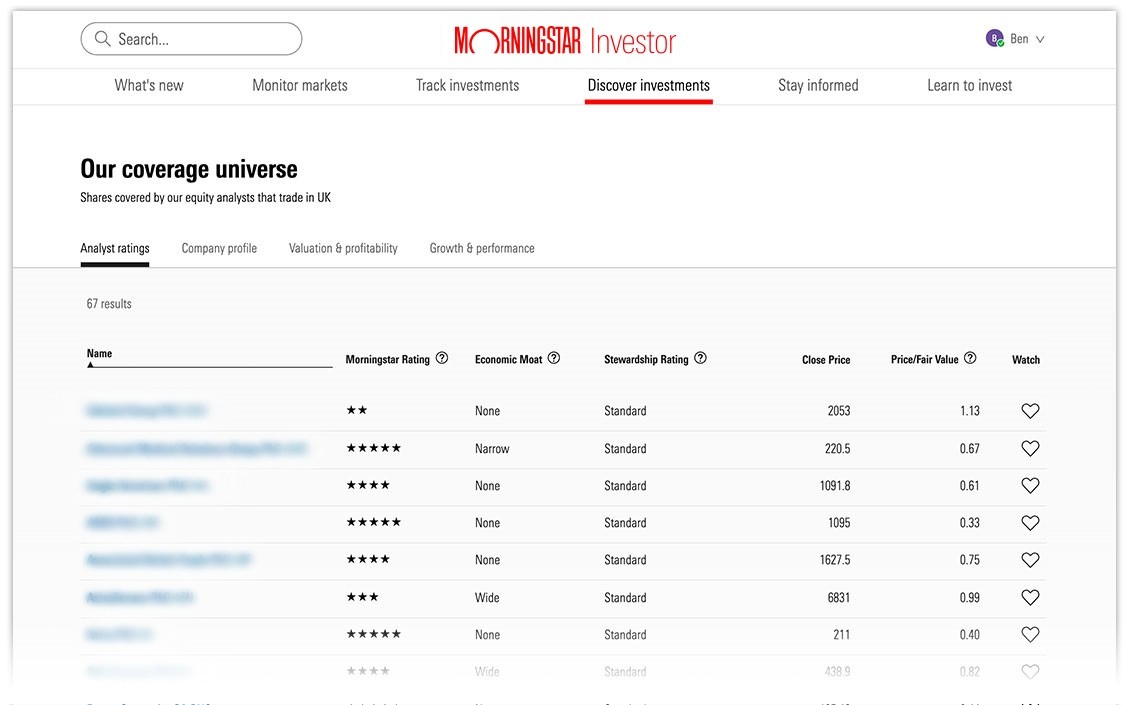

Discover investments

Find investment opportunities which fit your needs with our equities, ETFs, Funds and Hybrids coverage.

- Access qualitative analyst research on more than 1,600 stocks, forward-looking ratings on over 3,000 ETFs and managed funds, plus data on over 48,000 global securities

- Access our top equity picks, including sustainable dividend generating stocks, 5-star Australian and global stocks, 5-star Australian and global listed property stocks, sustainable investing stocks and more

- Easy-to-use, customisable filters to quickly identify investments which suit your goals

- Stock filter options include sector, market cap, dividend yield, franking percentage, payout ratio, Morningstar rating, economic moat, price/earnings ratio, return on equity, annualised return and more

- ETF and Fund filter options include yield, total cost ratio, annualised return, category, management style, Morningstar analyst rating, sustainability rating and more

- Keep an eye on price movements and Morningstar ratings as you wait for a more compelling opportunity with a customisable watchlist

No credit card needed.

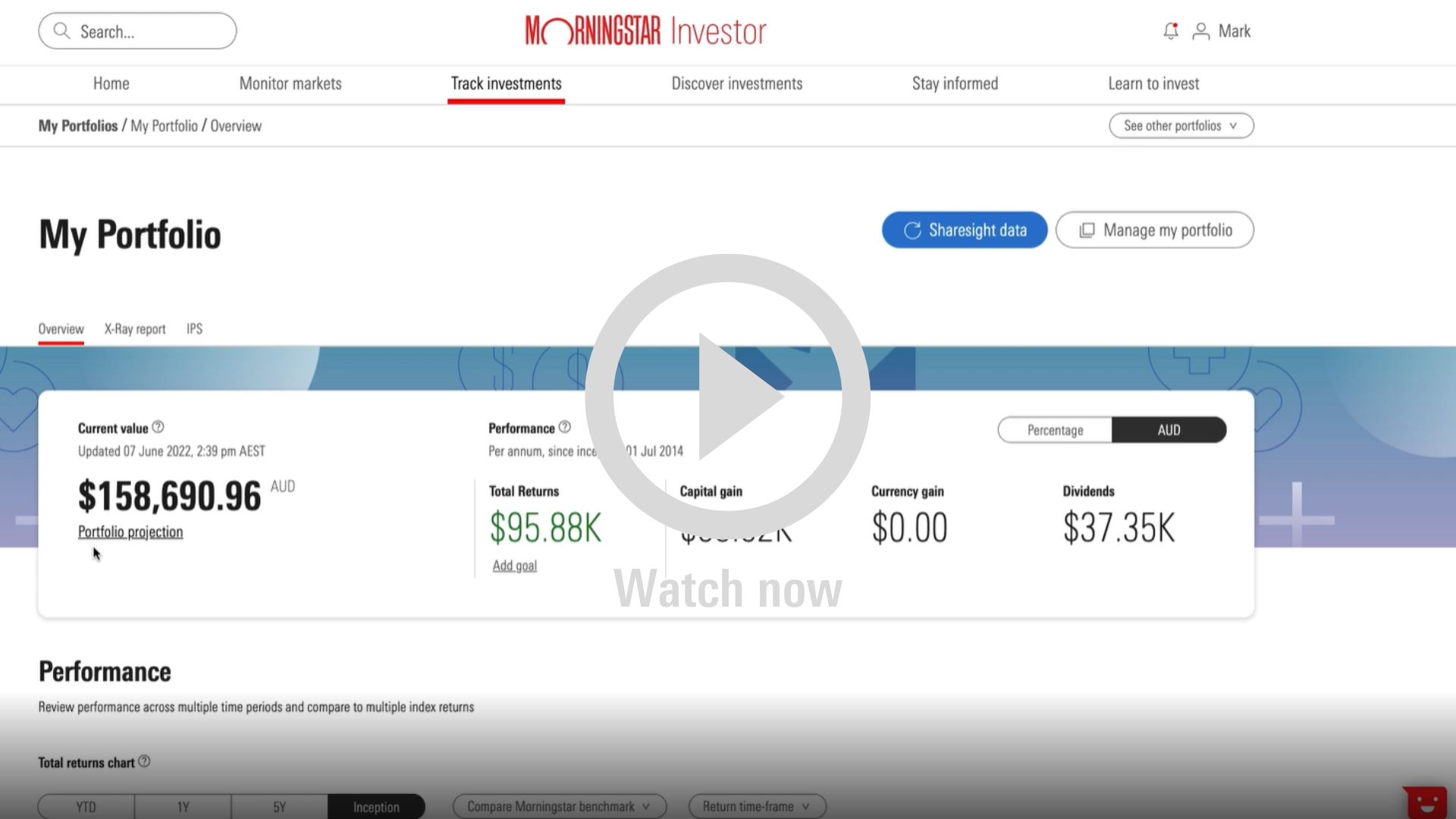

Track & analyse investments

Morningstar Investor includes complimentary access to Sharesight’s Standard Plan, one of Australia’s leading portfolio trackers (valued up to $372 p.a.) Sharesight’s integration into Morningstar Investor’s portfolio manager allows you to:

- Track all of your investments in a single location

- Easy dividend tracking with corporate actions automatically incorporated in portfolio reports

- An integration with Morningstar’s data and research: garner insights on your holdings from our team of equity and fund analysts

- Know your portfolio's true performance with daily price & currency updates

- Save time during tax time with streamline portfolio and tax reporting

- Know your exposure: Take a deep dive into your portfolio with Morningstar’s Portfolio X-Ray – get region, sector and style breakdowns

- Stay on top of your investments with email alerts for new corporate events, sudden movements in price, plus a weekly portfolio performance summary

No credit card needed.

Already a Sharesight user? We’ll pick up your bill (up to the value of the Standard Plan)

Monitor markets

We contextualise day to day market movements with our view of the overall market valuation so you can focus on the long-term investment opportunity.

- Explore index, commodity and currency changes

- See the current price to fair value of each market we cover along with the valuation from a year ago

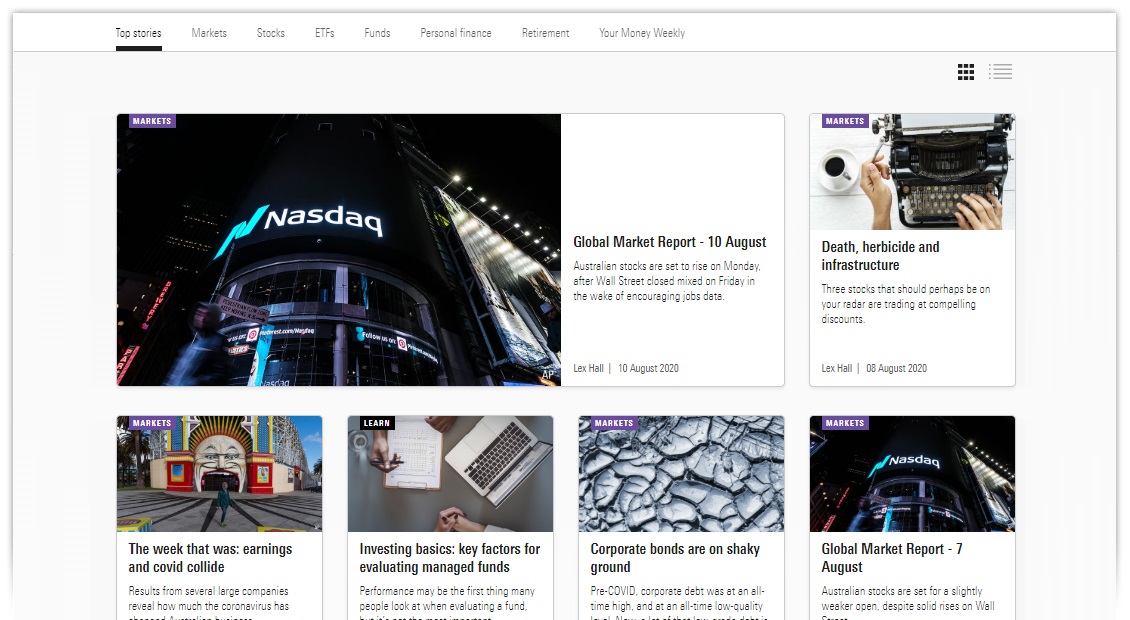

Stay informed

Our journalists in Australia, North America and Europe deliver insights from our wide breadth of equity, fund and ETF research, our in-house behavioural science researchers and our investment management team.

- A view on markets and investing focused on sound analysis rather than snap reactions to market events

- Access to our latest equity, fund and ETF research

- Commentary and insights on latest economic, political and business news

Learn to invest

Knowledge is the foundation of independence. As a Morningstar Investor member, you'll receive access to investing guides covering a wide range of topics. These are designed for both novice investors and experienced investors looking to review key foundational topics.

- Discover strategies to build wealth via stock, fund and ETF investing

- Learn fundamental frameworks for successful long-term investing

- How to build a portfolio aligned to your goals

No credit card required.

How to choose an ETF

Morningstar analysts evaluate over 200 ETFs trading on the ASX and identify those they think will be able to outperform in years to come.

When analysing ETFs, Morningstar considers:

PeopleIt is important to understand who is managing your money. There are a few considerations in our ETF analysis, some obvious, like tThe amount of experience the team has in managing ETFs. Analysts also tend to favour parent firms that put investors’ interests ahead of commercial goals and monitor how the ETF is trading on the exchange. ETFs sometimes trade with wider than normal buy/sell spreads, or deviate substantially from their net asset value, or NAV, which can jack up the costs to investors.

PriceMorningstar analysts consider explicit costs like the expense ratio, and implicit costs like the cost of portfolio turnover. We understand the significance of fees and costs, and the detrimental impact that it can have to performance outcomes. Top-rated funds are among the lowest cost options in their category, relative to their actively and passively managed peers.

ProcessFor passive products, analysts examine the fund's process – that is how the ETF are constructed, their underlying benchmarks, and the systems managers have put in place to achieve precise tracking of the benchmark.

For active funds, analysts focus on the fund mandate and distribution policies, the overall levels of transparency and how the portfolio managers attempt to minimise trading costs which can add implicit costs for investors.

PerformanceAlthough past performance is not an indicator of future performance, our analysts do consider performance in the context of evaluating people and process.

Medallist ratings are reserved for funds that analysts expect to deliver precise tracking of sensibly constructed indexes at a very low cost and backed by experienced managers. ETFs that analysts expect to outperform by the widest margin are rated Gold; next-highest conviction picks are rated Silver, followed by Bronze.

Medals are accompanied by the “analysts take” on the ETF – which includes their views on its suitability for investors, portfolio construction, fee and alternatives to consider.

^This offer is limited to new clients and cannot be used in combination with any other promotional offers and cannot be used to extend an existing Investor Membership. One free trial per household. Morningstar is licensed to provide our subscription service to Australian residents only.

© 2025 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This report has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or New Zealand wholesale clients of Morningstar Research Ltd, subsidiaries of Morningstar, Inc. Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

Legal Notices Privacy Policy Regulatory Disclosures Global Contacts