STOCKS

33 Undervalued ASX Stocks For 2026

We share our outlook for different sectors in Australia and highlight opportunities in 2026.

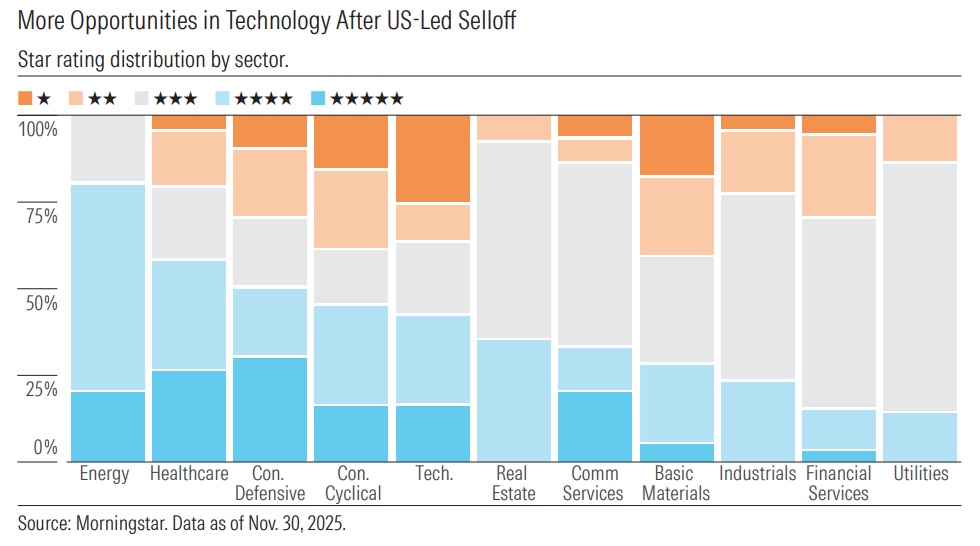

New Morningstar research has revealed that the energy, healthcare and consumer sectors are undervalued (as of Nov 30, 2025), as valuations become more reasonable.

We have identified several stocks trading at attractive prices, with certain names trading at discounts to their long-term intrinsic value of up to 40% or more as of 30 Nov 2025.

Morningstar valuation overview of Australian-listed firms under coverage as of 30 November 2025. 4- and 5-star ratings mean the stock is undervalued, while a 3-star rating means it's fairly valued, and 1- and 2-star stocks are overvalued.

Here’s a brief summary of how valuations stack up across sectors and where investors may find opportunities. Data is as of 30 November 2025.

Skip to sector:

- Energy

- Financial Services

- Technology

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Healthcare

- Industrials

- Real Estate

- Utilities

Energy

Uncertainty surrounding global oil supply and demand weighs on the share prices of hydrocarbon producers. But the renewable energy transition does not negate the value proposition, as we expect persistent conventional hydrocarbon demand.

Significant investment is required in most demand scenarios to backfill the decline in hydrocarbon supply, which naturally declines at 5% to 6% per year. This investment will only occur if hydrocarbon prices are good enough to support reasonable returns.

Longer term, we expect supply constraints to support our midcycle Brent crude oil price forecast of USD 65 per barrel. We expect aviation and non-fuel uses, such as plastics, to slow the decline in demand. We don’t expect any new major supply sources, such as deepwater or shale.

The outlook for liquefied natural gas is positive, particularly important for gas-exposed Australian hydrocarbon producers. LNG demand is expected to increase by almost 60% over the next 10 years, according to Wood Mackenzie. This assumes increasing GDP per capita in regions short of gas resources, and with the opportunity for LNG to displace coal in emerging markets and for gas-fired generation to back up intermittent renewables.

We assume reasonable Brent crude and contract LNG prices for our oil and gas producers’ fair value estimates. Despite this, shares trade materially below fair value.

Undervalued stocks in the Energy sector

To see undervalued stocks in the energy sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX energy stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the energy sector currently trading at a 4- or 5- star rating.

Financial Services

Another round of bank results is void of surprise and earnings growth, which makes valuations hard to justify. Credit growth is solid, well supported by population growth and resilient house prices. Margins are stable, and bad debts are very low.

Commonwealth Bank shares underperformed, with investors beginning to price in a greater chance that ANZ and Westpac will achieve cost-out ambitions. ANZ is lowering costs and settling regulatory issues, and Westpac is consolidating its technology across brands. Despite being no-moat, we see better value in smaller banks where the market does not expect cost savings to materially benefit, given competition. Banks all hold surplus capital, which supports modest dividend growth. Given the commoditized nature of general insurance, we expect competition to erode the excess profits general insurers enjoy. Steadfast lowered average premium rate-increase expectations for fiscal 2026 to 1%-2%, from 3%-5%, suggesting insurers are competing for market share on price. General insurers are overvalued, with the market pricing in margins and returns well above the historical average.

On average, our covered asset managers are likely to see a gradual long-term earnings decline. The post-April 2025 equity market recovery was much stronger than we expected, leading to resilient flows and strong investment returns, resulting in higher funds under management to support near-term earnings. But over time, as rate cuts are priced in, volatility rises from prior lows and competition plays out—we expect net flows to slow, with fee compression and higher investments in distribution constraining long-term earnings growth.

Credit growth is healthy, with total growth on an annualized basis of 7.5% in the three months to September 2025. Our expectation is credit growth slows to 4% to 5% from 2026, with the boost from cash rate cuts likely behind.

We anticipate continued fee compression across all covered firms’ investment strategies through to fiscal 2030. We believe the broader trend on fees is downward, as competition from passive funds continues to exert fee pressure.

Undervalued stocks in the Financial Services sector

To see undervalued stocks in the financial services sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX financial services stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the financial services sector currently trading at a 4- or 5- star rating.

Technology

The technology sector has underperformed the broader Australian market since the August earnings season. WiseTech, the index’s largest component, initially fell on a weak outlook for fiscal 2026 and then with a raid of its offices by ASIC and the AFP in October on suspicions of insider trading. Some names we considered overvalued also experienced large falls as stretched valuations were tested. Despite the falls, we still see the sector as materially overvalued.

Technology companies are prime beneficiaries of a softening interest rate outlook, as US President Donald Trump appears to be browbeating Federal Reserve Chair Jerome Powell to lower rates. Additionally, the AI revolution marches on, as Nvidia continues to beat market expectations, and the technology sector, as the most adjacent sector, benefits most directly from this tide that lifts most boats.

But these are mostly nonfundamental drivers. Interest rates can only be pushed down artificially for so long. As AI, not a key driver for most of our ANZ technology coverage, matures, the narrative around AI will be tested to reality. We therefore prefer companies whose share prices aren’t reliant on such temporary drivers but long-term fundamentals.

Undervalued stocks in the Technology sector

To see undervalued stocks in the technology sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX technology stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the technology sector currently trading at a 4- or 5- star rating.

Basic Materials

Optimism about improved economic growth and commodity demand has seen basic materials outperform other sectors on the ASX, and it remains overvalued on average.

The lithium carbonate equivalent price is up around 40% over the quarter, to about USD 13,000 per metric ton, on rapidly rising demand, but remains below our medium-term estimate of around USD 20,000 on average. Shares of our lithium coverage have risen along with higher prices.

Iron ore, copper, and metallurgical coal prices are broadly stable on last quarter. The gold price is again up, albeit highly volatile, and close to historical highs. Our gold coverage is materially overvalued, unsurprising given the metals’ amazing run.

Mineral sands prices are in a cyclical downturn on depressed demand. We think shares will benefit from improving mineral sands demand as well as from higher rare earths prices driven by the west’s attempts to reduce its dependence on China, which controls the rare earths supply chain.

Lithium prices are up on rapidly rising demand for use in electric vehicles and battery energy storage systems, and as higher-cost supply exits, reducing the market oversupply.

Undervalued stocks in the Basic Materials sector

To see undervalued stocks in the basic materials sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX basic materials stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the basic materials sector currently trading at a 4- or 5- star rating.

Communication Services

The telecommunication sector performed strongly in the quarter. The medium-term outlook is solid, especially for mobile. Revenue per user is increasing despite growing competition from mobile virtual network operators. Mobile accounts for approximately half of the earnings for the incumbent telecoms under our coverage.

Cost management and efficiency are now a way of life for all telecoms. We expect steady EBITDA growth, with EBITDA margins plateauing over the medium term. This earnings resilience, coupled with falling capex intensity, should see continuing improvement in free cash flow.

Media has underperformed the market in the recent quarter, affected by the deterioration of advertising conditions. In fact, Australia’s television advertising market abruptly slumped by approximately 13% in October. While there are undeniable structural pressures, we believe most media names are fundamentally cheap. Worsening advertising conditions will incentivize further cost-cutting, and we expect more consolidation.

The pessimistic consensus view ignores the growth in the companies’ digital assets and the increasing discipline on cost management. We believe that more costs can be cut, especially with staff production and second-tier programming. Considering media shares trade at 3 to 6 times our EBITDA forecasts, little needs to go right for the shares to rerate.

Lifting average mobile revenue per user, coupled with continuing improvements in cost efficiency, should support telecoms EBITDA margins. Free cash flow will subsequently improve as the peak of capital expenditure for 5G infrastructure has passed.

Media companies need to increase their effort to cut costs given the sudden decline in advertising conditions. Employee costs need to reflect the structural decline in traditional media advertising. The same can be said for programming and content costs.

Undervalued stocks in the Communication Services sector

To see undervalued stocks in the communication services sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX communication services stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the communication services sector currently trading at a 4- or 5- star rating.

Consumer Cyclical

The near-term outlook for consumer cyclicals is positive. After a multiyear slump, consumer sentiment is now positive. Real household incomes are growing again, with rampant inflation and its associated impact on the cost of living behind. The savings rate is back to normal levels, and interest rate cuts help household budgets. We expect these factors to support discretionary spending, particularly demand for large goods.

But we think the improved outlook is largely priced in, leaving cyclicals modestly overvalued on average. While conditions support revenue growth, we expect competition to constrain profit margins for many discretionary retailers. During the pandemic boom, retailers enjoyed above-average demand growth and higher realized prices, coupled with relatively muted cost pressures. But these conditions were unusual. Margins have since normalized, and we don’t envisage another macroeconomic event supporting another period of material margin expansion. This view differs from the market for much of our overvalued cyclical coverage.

In a threat to consumer sentiment and interest rates, inflation is beginning to creep up again, now above the Reserve Bank of Australia’s target of 2%-3%. Households are increasing their spending, not savings, with rising incomes. Some components of inflation, like electricity prices, are rising due to temporary factors. Nevertheless, the RBA expects inflation to stay above 3% through 2026.

Consumer sentiment is improving sharply. After a multiyear slump, households are finally optimistic again. We expect more confident consumers to support discretionary sales growth, particularly big-ticket items like new cars and appliances. But inflation is rising again, and this poses a risk to both low interest rates and the optimistic consumer sentiment. After initially increasing savings, households are now spending more of their income on goods following more recent interest rate cuts.

Undervalued stocks in the Consumer Cyclical sector

To see undervalued stocks in the consumer cyclical sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX consumer cyclical stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the consumer cyclical sector currently trading at a 4- or 5- star rating.

Consumer Defensive

Large-cap defensive retailers Woolworths and Endeavour are both struggling to reinvigorate sales momentum. Both are cutting prices and giving up profit margin to get shoppers in the door. We expect Coles to match the discounts. Woolworths is losing market share to Coles as it works to restore customer trust in prices. Nevertheless, we think Woolworths’ structural cost advantage over Coles enables it to cut prices more than Coles and ultimately lure shoppers back. We expect a focus on discounting to put price pressure on suppliers, where the balance of power in this relationship sits firmly with the supermarkets. While we expect the period of heightened supermarket discounting to pass, it could help the RBA in the short term. Australian inflation is picking up, but lower food and liquor prices could alleviate some pressure. Food prices account for close to one-fifth of the CPI, which measures inflation.

Australians are cutting back on liquor spending, and liquor retailers are reacting to cyclically soft demand with more promotions. But we don’t see structural weakness. While sales are still subdued, as consumers trade down to cheaper options, we estimate liquor retailing volumes are now back to long-term trend levels, after the pandemic related spike in at-home consumption. We think liquor sales momentum can improve alongside household incomes now that sales volumes are at durable levels.

At-home liquor consumption is sluggish, rebasing after a sales bonanza during lockdowns.

Undervalued stocks in the Consumer Defensive sector

To see undervalued stocks in the consumer defensive sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX consumer defensive stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the consumer defensive sector currently trading at a 4- or 5- star rating.

Healthcare

We view the healthcare sector as overvalued on average, but about half of our coverage is 4- or 5-star-rated.

Vaccine declines were inevitable after the pandemic boom, but infections remain high. We expect US immunization to largely stabilize by fiscal 2028 as health practitioners drive rates and the US administration maintains its positive recommendation with efficacy supported by clinical evidence.

With insurers also paying a higher payout ratio on increasing premiums, we forecast revenue growth to outpace expenses.

Undervalued stocks in the Healthcare sector

To see undervalued stocks in the healthcare sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX healthcare stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the healthcare sector currently trading at a 4- or 5- star rating.

Industrials

Most of our industrials coverage has suffered cyclical weakness over fiscal 2026. For our building exposed coverage, higher interest rates than recent history weigh on demand for new construction, and repairs and renovations. For packaging companies, customers are buying fewer discretionary goods and choosing cheaper products.

We expect federal-funds rate cuts to encourage a return to consumer spending for US-exposed companies. The market anticipates this could come as soon as December, and we think it is likely to take a few months for the flow-through effect to be felt. We expect further rate cuts to continue through to 2027, extending the recovery to the cyclically exposed companies.

US goods consumption is expected to worsen. Main drivers are the need to bolster household savings and slowing population growth, due to tighter immigration policy.

The year ending June 2025 marked the first year of the Australian federal government’s five-year target to build 1.2 million homes. Just 170,000 homes were built, not dissimilar to recent history. Significant catch-up is required if the target is to be achieved.

Undervalued stocks in the Industrials sector

To see undervalued stocks in the industrials sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX industrial stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the industrials sector currently trading at a 4- or 5- star rating.

Real Estate

The sector underperformed in the December quarter, as persistent inflation dashed hopes for another rate cut before the end of 2025. After the most recent dip, the sector is now modestly undervalued.

Residential developers, including land lease operators, are set to benefit from Australia’s housing shortage and affordability crisis. The 5% Deposit Scheme, effective Oct. 1, 2025, accelerated home price growth. In October alone, national dwelling values sprang 1.1%, the highest monthly gain since May 2023, as supply struggles to keep pace with demand. In the June quarter (the latest available data), ABS reported new dwelling completions at their lowest in a decade. While there are signs of improvement, dwelling approvals are well below the 2017 and 2021 peaks.

Inflation in building materials and construction wages is normalizing, but the challenges of high building costs are not over. The number of builder insolvencies spiked to a multiyear record in October, reversing brief declines. As interest rates moderate and construction cost inflation stabilize, we expect margins to improve for residential and land lease developers. However, some companies are likely to suffer near-term margin headwinds.

New community development is a key growth driver for land lease operators. However, development earnings are more volatile than rental income from settled homes, given the inherent exposure to housing cyclicality, cost inflation, and construction delays.

Building conditions are stabilizing. Building material price inflation has returned to pre-covid levels. Labor wage inflation in the construction industry remains elevated, but pleasingly, it has moderated from the peaks in 2024.

Undervalued stocks in the Real Estate sector

To see undervalued stocks in the real estate sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX real estate stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the real estate sector currently trading at a 4- or 5- star rating.

Utilities

We generally see overvaluation in Australasian utilities. In Australia, electricity futures prices have drifted lower with mild weather. This is a modest headwind for earnings as it will flow through to retail prices. But futures prices are still attractive, and otherwise, operating conditions are favorable.

Upward pressure on electricity bills resumed after the removal of government rebates and on underlying tariff increases. We expect further pressure as network charges rise.

Corporate bond yields have fallen since 2022 despite a gradual increase in Australian government bond yields. This is good news for highly geared companies, as interest expense is its largest cost.

Undervalued stocks in the Utilities sector

To see undervalued stocks in the utilities sector, sign up for a FREE 4-week trial^ of Morningstar Investor (no credit card needed) to access all our latest best ASX utilities stock picks inside our ‘Australian Equity Market Outlook Q1 2026’ Your Money Weekly issue, plus our premium stock screener that will help you identify all stocks in the utilities sector currently trading at a 4- or 5- star rating.

Looking for more stock ideas?

The Morningstar Rating for shares can help investors uncover stocks that are truly undervalued, cutting through the market noise.

Investors can turn to several metrics to gauge a stock’s worth. Some investors use standard metrics, such as price/earnings or price/cash flows. Others may look at a stock’s price relative to a company’s future growth prospects, or where a stock is trading relative to its 52-week high price.

At Morningstar, we define undervalued stocks as those that are trading below our calculated fair value estimate, adjusted for what we call uncertainty—both of which are wrapped into the Morningstar Rating for stocks. Stocks rated 4 and 5 stars are undervalued; those rated 3 stars are fairly valued, and those rated 1 or 2 stars are overvalued.

To see our current 5-star rated stocks and best ideas, or screen our database of over 46,000 ASX & Global companies, sign up for a FREE 4-week trial^ of Morningstar Investor.

5-star Australian shares

Global equity best ideas

Australian stocks with moats

Inexpensive growth

Sustainable income

Inexpensive quality

5-star North American shares

5-star Asian stocks

About Us

Morningstar started with an idea—one great idea from a 27-year-old stock analyst. Joe Mansueto thought it was unfair that people didn’t have access to the same information as financial professionals. So he hired a few people and set up shop in his apartment in 1984—to deliver investment research to everyone.

Since then, we've empowered millions of investors all over the world, and we’re continuing to look for new ways to help people achieve financial security.

Our research is independent, which means we do not charge or accept payment or commissions from fund managers, listed companies or other product issuers to produce research on their products.